tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,445

- Reactions

- 6,468

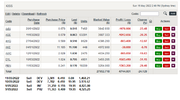

Some are impressed with what seems to be complexity.What is the point of posting a chart with a lot of lines on it if you have not labeled the lines. How can anyone get any benefit from this information without knowing what the lines represent. It's difficult to see where the ship is heading when it's in stormy weather.

Reality is that there are just a few indicators like Bollinger, Various Parabolic SAR

and Resistance along with an RSI and the odd trend line.. All with no real predictive,

Anticipatory value, particularly in a range.