- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,351

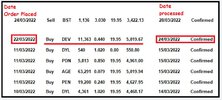

@Skate why is DEV in and the rest out I bought the rest before DEV. I think you are looking at the settlement date and not the purchase date...very confused!

@Ann that's the issue. You purchased all the positions listed before (DEV). To have those positions included in the portfolio they should have been reported before the last report & at the time they were actioned. (ie, the "Record Date)

To be included in the Portfolio

The movement of any positions must be been between 20th March to 25th March 2022. Last week's report closed on the "20th March 2022" & this week's report closed today "27th March 2022".

Any additions or deductions to today's records

These movements can only be from movements from tomorrow to the end of trade Friday (28th March to the 1st April 2022 inclusive)

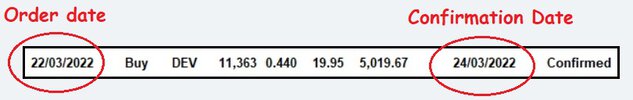

DEV falls within the last trading period

It appears the buy order for (DEV) was placed on 22nd March 2022 & the purchase was confirmed/transacted on the 24th March 2022 (within the last trading week).

Why are the positions below excluded?

For the simple reason that the movement of these positions must have been between "20th March to 25th March 2022". The movement of all these positions occurred before the last report. I'm just saying "you should have reported them during the correct time period".

Transactions have not been reported correctly

The records below should have been reported during the week of the "14th March 2022 to 18th March 2022". The positions should have been reported & included at the "record date" for the week they were actioned.

(1) SMR (14/3/2022)

(2) DYL (15/3/2022)

(3) PDN (15/3/2022)

(4) AGE (15/3/2022)

(5) PEN (15/3/2022)

(6) DYL (14/3/2022)

Summary

(DEV) is applicable to this week's report as the transaction date falls within the last trading period. You can't place buy & sell positions "before the last report", otherwise, that's fudging. I hope this clears up the confusion.

Skate.