- Joined

- 13 February 2006

- Posts

- 5,091

- Reactions

- 11,571

Oil News:

Global LNG exports grew at the slowest pace since 2015 despite natural gas demand being forecast to grow by around 2.5% this year, with limited capacity additions adding to pricing pressures seen across the year.

- Annual LNG shipments will total 414 million tonnes of LNG in 2024, up a marginal 0.4% compared to the previous year, with the United States posting the same 87 million tonnes as it did in 2023.

- Production ramp-up at two new US liquefaction terminals should boost LNG trade volumes next year, with Venture Global starting up Plaquemines last week and Cheniere producing first gas at Corpus Christi on Monday.

- Russia’s LNG ambitions were derailed by US sanctions that debilitated the 19.8 mtpa Arctic LNG 2 project, therefore Qatar would be the closest competitor of the US as it aims for a 2026 launch of the supergiant North Field East expansion project.

Market Movers

- Portugal’s oil firm Galp Energia (ELI:GALP) reported a fourth light oil reservoir discovery at the Mopane prospect in offshore Namibia, boosting hopes it could genuinely hold 10 billion barrels.

- Colombia’s state-controlled oil firm Ecopetrol (NYSE:EC) agreed to buy the remaining 45% share in Colombia’s CPO-09 onshore block from Spanish peer Repsol (BME:REP) for an undisclosed sum.

- Italy’s oil major ENI (BIT:ENI) started the second phase of the Baleine field in offshore Ivory Coast, adding 60,000 b/d in production capacity and effectively doubling the country’s total output.

Tuesday, December 31, 2024

The last quarter of 2024 will go down as one of the most rangebound predictable trading periods in recent history as oil prices traded within a very narrow bandwidth, between $71 and $81 per barrel, for three months that have seen a high-impact OPEC+ meeting, Trump’s re-election, and continuous Chinese doom. ICE Brent futures will end the year at $74 per barrel, a $1 per barrel increase month-over-month, in extremely thin trading.

Puerto Rico Wakes Up in Darkness. Electricity supply across the island of Puerto Rico has collapsed as more than 90% of households were without power on New Year’s Eve, with lack of investment into post-hurricane infrastructure recovery leaving only one back-up plant generating energy.

Cheniere Hits New LNG Milestone. US LNG developer Cheniere Energy (NYSE:LNG) announced it produced first liquefied gas from Stage 3 of the Corpus Christi LNG project, with full commissioning of the 1.5 mtpa capacity Train 1 of the liquefaction facility expected by March 30 next year.

White House Protects Nevada from Drillers. The Biden administration approved a request from the US Forest Service to withdraw 264,442 acres in the Ruby Mountains of northeast Nevada from oil, gas and geothermal development for 20 years, less than three weeks before Trump’s inauguration.

Iraq Greenlights Key Infrastructure Project. The Iraqi government sanctioned the 2.25 million b/d Basrah-Haditha oil pipeline project that would finally connect oil fields in the south of the country with central regions around Baghdad, with a preliminary price tag pencilled in at $4.6 billion.

Russia to Stop Exporting Gas to Moldova. Russia’s gas major Gazprom said it would suspend all pipeline gas exports to Moldova on January 1 due to the country’s unpaid debt, assessed around 710 million, putting an end to some 2 bcm per year of supplies that have been piped via Ukraine.

Beijing Wants More Fuel Oil Levies. The Chinese government plans to raise duties on imported fuel oil from 1 January 2025, lifting the levy from 1% currently to 3%, adding approximately $2 per barrel to the cost of imports for refiners as many used Russian and Iranian fuel oil to replace crude.

Airlines Stocks Rebound from COVID Slump. US airlines have been one of the top stock performers in the energy space as the S&P Supercomposite Airlines Index jumped 60% in 2024, double the annual gain in the S&P 500 Index, with US travel activity beating all previous records.

Hedge Funds Get Bullish Again on Oil. Bullish bets on oil reached a 4-month high after hedge funds and other money managers added their long positions by a further 21,694 lots in the week ended December 24, positioning themselves for potential price spikes as Trump returns to office.

Europe Braces for Cold January Weather. European gas prices have soared to €49 per MWh as the Russia-Ukraine transit saga drags on and weather forecasts indicate a sharp drop in temperatures across Northwest Europe in early January, with the cold snap potentially persisting all next month.

Australian Output to See Plunge in 2025. Australia’s leading oil producer Santos (ASX:STO) will decommission the Ningaloo Vision FPSO next year, putting an end to production at the heavy Van Gogh, Coniston and Novara offshore fields after less than 15 years in operation.

Nigeria’s Refineries Keep on Coming Back. Nigeria’s 125,000 b/d Warri refinery has resumed operations after a decade of shutdowns, initially blamed on dilapidation and crude shortages, the second NNPC-operated downstream asset in the country that was brought back to life in 2024.

EV Battery Costs Collapse on Cheap Metals. The raw materials bill for an average EV battery now stands around $510 compared to $1900-2000 at the beginning of 2023, driven by lithium’s 75% plunge but also boosted by declining prices for cobalt and nickel, down 34% and 25%, respectively.

Top Performer Cocoa Set to Rise Higher. Cocoa, the best-performing commodity of 2024 boosting an annual gain of 175%, is set for further growth in 2025 as farmers in Ivory Coast, the world’s largest cocoa producer, reported a deterioriation in crop quality amidst intense rains and Harmattan winds.

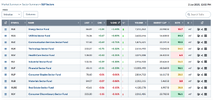

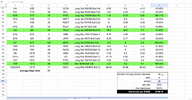

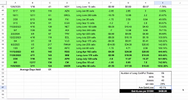

On Friday, we published our annual recap report for 2024. The report provides a complete rundown of everything that went on across financial markets this year, including the trend of incredible concentration in stocks up at the top. Replicated below is a chart from that report showing the combined market cap of the S&P 500's eight largest stocks as a percentage of total S&P 500 market cap for each year going back to 1994.

Currently, the eight largest members of the S&P—at the moment those are the Magnificent Seven names plus the newest trillion-dollar stock: Broadcom (AVGO)—account for 35.6% of S&P 500's total market cap. That's a record high. We would also note that the growing share of the S&P 500's market cap that this small handful of stocks accounts for isn't exactly a new phenomenon. Over the past decade, the largest stocks' share of market cap has steadily been growing, and actually, this isn't the only record high to highlight with prior records being set at 29% at the end of 2021 and 30% last year. With that said, the 5.6 percentage point jump versus last year is one of the largest one-year increases in concentration at the top that we've seen.

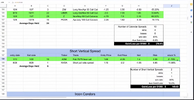

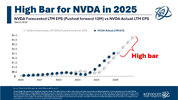

Drilling down a step deeper, below we again show the collective share of S&P 500 market cap possessed by the eight largest members for each year since 1994, but this time with a breakdown by sector. Of the current group of largest stocks, half belong to the Tech sector: NVIDIA (NVDA), Apple (AAPL), Microsoft (MSFT), and Broadcom (AVGO). Of course, zooming out for context, the Tech sector, as a whole, holds a historically massive S&P 500 weighting at 32%, but these four stocks alone account for a huge share (21.5 percentage points) of that. In other words, the S&P 500 is heavily concentrated in Tech, and Tech is heavily concentrated in these four stocks.

As for the other largest members, Communication Services names—Meta Platforms (META) and Alphabet (GOOGL)—account for a combined 7.21% of the S&P 500's total market cap and the remaining two names from the Consumer Discretionary sector—Tesla (TSLA) and Amazon (AMZN)—are to thank for 6.95%.

As for the rest of the sectors, 2024 is going to end with Financials not having a single stock in the eight largest S&P members for the first time since 2009. This is thanks to Broadcom (AVGO) unseating Berkshire Hathaway (BRK.B) as the index's eighth largest stock. Meanwhile, Industrials hasn't had a stock land in the top eight since 2015, and Consumer Staples has now gone a decade without a top eight stock. In the past five years, Health Care has only found its way into this group once in 2022, but otherwise, it has been absent. Materials, Real Estate, and Utilities haven't had a member land in the top eight largest stocks in any year since at least 1993.

Again, the present situation is historic. Aside from there never having been such a large share of the S&P 500's market cap coming from the top, there also hasn't been a year since at least 1993 when these top eight stocks have had such narrow sector representation. As shown below, only three sectors are represented among the S&P 500's top eight stocks. Historically, it has been most common to see six different sectors represented among these eight names.

Full:https://www.wsj.com/finance/investi...b?st=caNkg6&reflink=desktopwebshare_permalink

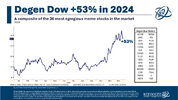

A pretty good year for the bulls.

jog on

duc

Global LNG exports grew at the slowest pace since 2015 despite natural gas demand being forecast to grow by around 2.5% this year, with limited capacity additions adding to pricing pressures seen across the year.

- Annual LNG shipments will total 414 million tonnes of LNG in 2024, up a marginal 0.4% compared to the previous year, with the United States posting the same 87 million tonnes as it did in 2023.

- Production ramp-up at two new US liquefaction terminals should boost LNG trade volumes next year, with Venture Global starting up Plaquemines last week and Cheniere producing first gas at Corpus Christi on Monday.

- Russia’s LNG ambitions were derailed by US sanctions that debilitated the 19.8 mtpa Arctic LNG 2 project, therefore Qatar would be the closest competitor of the US as it aims for a 2026 launch of the supergiant North Field East expansion project.

Market Movers

- Portugal’s oil firm Galp Energia (ELI:GALP) reported a fourth light oil reservoir discovery at the Mopane prospect in offshore Namibia, boosting hopes it could genuinely hold 10 billion barrels.

- Colombia’s state-controlled oil firm Ecopetrol (NYSE:EC) agreed to buy the remaining 45% share in Colombia’s CPO-09 onshore block from Spanish peer Repsol (BME:REP) for an undisclosed sum.

- Italy’s oil major ENI (BIT:ENI) started the second phase of the Baleine field in offshore Ivory Coast, adding 60,000 b/d in production capacity and effectively doubling the country’s total output.

Tuesday, December 31, 2024

The last quarter of 2024 will go down as one of the most rangebound predictable trading periods in recent history as oil prices traded within a very narrow bandwidth, between $71 and $81 per barrel, for three months that have seen a high-impact OPEC+ meeting, Trump’s re-election, and continuous Chinese doom. ICE Brent futures will end the year at $74 per barrel, a $1 per barrel increase month-over-month, in extremely thin trading.

Puerto Rico Wakes Up in Darkness. Electricity supply across the island of Puerto Rico has collapsed as more than 90% of households were without power on New Year’s Eve, with lack of investment into post-hurricane infrastructure recovery leaving only one back-up plant generating energy.

Cheniere Hits New LNG Milestone. US LNG developer Cheniere Energy (NYSE:LNG) announced it produced first liquefied gas from Stage 3 of the Corpus Christi LNG project, with full commissioning of the 1.5 mtpa capacity Train 1 of the liquefaction facility expected by March 30 next year.

White House Protects Nevada from Drillers. The Biden administration approved a request from the US Forest Service to withdraw 264,442 acres in the Ruby Mountains of northeast Nevada from oil, gas and geothermal development for 20 years, less than three weeks before Trump’s inauguration.

Iraq Greenlights Key Infrastructure Project. The Iraqi government sanctioned the 2.25 million b/d Basrah-Haditha oil pipeline project that would finally connect oil fields in the south of the country with central regions around Baghdad, with a preliminary price tag pencilled in at $4.6 billion.

Russia to Stop Exporting Gas to Moldova. Russia’s gas major Gazprom said it would suspend all pipeline gas exports to Moldova on January 1 due to the country’s unpaid debt, assessed around 710 million, putting an end to some 2 bcm per year of supplies that have been piped via Ukraine.

Beijing Wants More Fuel Oil Levies. The Chinese government plans to raise duties on imported fuel oil from 1 January 2025, lifting the levy from 1% currently to 3%, adding approximately $2 per barrel to the cost of imports for refiners as many used Russian and Iranian fuel oil to replace crude.

Airlines Stocks Rebound from COVID Slump. US airlines have been one of the top stock performers in the energy space as the S&P Supercomposite Airlines Index jumped 60% in 2024, double the annual gain in the S&P 500 Index, with US travel activity beating all previous records.

Hedge Funds Get Bullish Again on Oil. Bullish bets on oil reached a 4-month high after hedge funds and other money managers added their long positions by a further 21,694 lots in the week ended December 24, positioning themselves for potential price spikes as Trump returns to office.

Europe Braces for Cold January Weather. European gas prices have soared to €49 per MWh as the Russia-Ukraine transit saga drags on and weather forecasts indicate a sharp drop in temperatures across Northwest Europe in early January, with the cold snap potentially persisting all next month.

Australian Output to See Plunge in 2025. Australia’s leading oil producer Santos (ASX:STO) will decommission the Ningaloo Vision FPSO next year, putting an end to production at the heavy Van Gogh, Coniston and Novara offshore fields after less than 15 years in operation.

Nigeria’s Refineries Keep on Coming Back. Nigeria’s 125,000 b/d Warri refinery has resumed operations after a decade of shutdowns, initially blamed on dilapidation and crude shortages, the second NNPC-operated downstream asset in the country that was brought back to life in 2024.

EV Battery Costs Collapse on Cheap Metals. The raw materials bill for an average EV battery now stands around $510 compared to $1900-2000 at the beginning of 2023, driven by lithium’s 75% plunge but also boosted by declining prices for cobalt and nickel, down 34% and 25%, respectively.

Top Performer Cocoa Set to Rise Higher. Cocoa, the best-performing commodity of 2024 boosting an annual gain of 175%, is set for further growth in 2025 as farmers in Ivory Coast, the world’s largest cocoa producer, reported a deterioriation in crop quality amidst intense rains and Harmattan winds.

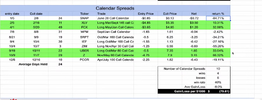

- Over the past two weeks, Nasdaq 100 futures have coiled into a tight Triangle pattern, setting the stage for a meaningful resolution in either direction as we enter the new year.

- Clearing 22,222 would confirm a breakout, while violating 21,000 would confirm a breakdown. Either way, the Nasdaq is nearing a decision point.

- Consolidation patterns typically resolve in the direction of the underlying trend, which, in this case, is higher. However, when they don't, it often indicates trend exhaustion.

On Friday, we published our annual recap report for 2024. The report provides a complete rundown of everything that went on across financial markets this year, including the trend of incredible concentration in stocks up at the top. Replicated below is a chart from that report showing the combined market cap of the S&P 500's eight largest stocks as a percentage of total S&P 500 market cap for each year going back to 1994.

Currently, the eight largest members of the S&P—at the moment those are the Magnificent Seven names plus the newest trillion-dollar stock: Broadcom (AVGO)—account for 35.6% of S&P 500's total market cap. That's a record high. We would also note that the growing share of the S&P 500's market cap that this small handful of stocks accounts for isn't exactly a new phenomenon. Over the past decade, the largest stocks' share of market cap has steadily been growing, and actually, this isn't the only record high to highlight with prior records being set at 29% at the end of 2021 and 30% last year. With that said, the 5.6 percentage point jump versus last year is one of the largest one-year increases in concentration at the top that we've seen.

Drilling down a step deeper, below we again show the collective share of S&P 500 market cap possessed by the eight largest members for each year since 1994, but this time with a breakdown by sector. Of the current group of largest stocks, half belong to the Tech sector: NVIDIA (NVDA), Apple (AAPL), Microsoft (MSFT), and Broadcom (AVGO). Of course, zooming out for context, the Tech sector, as a whole, holds a historically massive S&P 500 weighting at 32%, but these four stocks alone account for a huge share (21.5 percentage points) of that. In other words, the S&P 500 is heavily concentrated in Tech, and Tech is heavily concentrated in these four stocks.

As for the other largest members, Communication Services names—Meta Platforms (META) and Alphabet (GOOGL)—account for a combined 7.21% of the S&P 500's total market cap and the remaining two names from the Consumer Discretionary sector—Tesla (TSLA) and Amazon (AMZN)—are to thank for 6.95%.

As for the rest of the sectors, 2024 is going to end with Financials not having a single stock in the eight largest S&P members for the first time since 2009. This is thanks to Broadcom (AVGO) unseating Berkshire Hathaway (BRK.B) as the index's eighth largest stock. Meanwhile, Industrials hasn't had a stock land in the top eight since 2015, and Consumer Staples has now gone a decade without a top eight stock. In the past five years, Health Care has only found its way into this group once in 2022, but otherwise, it has been absent. Materials, Real Estate, and Utilities haven't had a member land in the top eight largest stocks in any year since at least 1993.

Again, the present situation is historic. Aside from there never having been such a large share of the S&P 500's market cap coming from the top, there also hasn't been a year since at least 1993 when these top eight stocks have had such narrow sector representation. As shown below, only three sectors are represented among the S&P 500's top eight stocks. Historically, it has been most common to see six different sectors represented among these eight names.

Full:https://www.wsj.com/finance/investi...b?st=caNkg6&reflink=desktopwebshare_permalink

A pretty good year for the bulls.

jog on

duc