- Joined

- 20 July 2021

- Posts

- 11,671

- Reactions

- 16,259

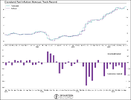

the depends on how much extra 'adjusting of the data ' they are doing to the CPICorrection for previous post, CPI was 7% in October, estimated CPI in December is 3.47% so far.

What does the Fed tend to do when CPI starts to fall? Fed funds rate follows the CPI... Question now is will they plateau? Do they need to plateau given they've been hiking into a falling CPI?

View attachment 150737