- Joined

- 3 November 2013

- Posts

- 1,570

- Reactions

- 2,776

Russia bans oil sales to nations imposing a price cap...

WHOOPS !Russia bans oil sales to nations imposing a price cap...

Of course, that does not prohibit countries who did not put ona price cap from buying oil from Russia (at whatever price and currency the two parties choose), and then on selling the oil to those price capping nations (at whatever price and in what currency both parties choose).Russia bans oil sales to nations imposing a price cap...

MickIn the early ‘90s, legendary investigative journalist Seymour Hersh revealed the "Samson Option," a secret Israeli nuclear deterrence strategy.

It states that in a scenario where its enemies were about to overrun the country, Israel would respond with massive use of nuclear weapons as a last resort.

The concept comes from the biblical figure Samson, who pushed apart the pillars of a Philistine temple, bringing down the roof and killing himself and the Philistines who had captured him.

In short, the Samson Option is a threat that says, "if we’re going down, we are taking you with us."

I am bringing this up because governments also have a financial Samson Option… and they could soon use it to a devastating effect.

Thanks to central banking and fiat currency, governments can steal a nation’s savings through inflation. In the event of a bankruptcy, or other existential situations, governments can tap into the wealth of a nation as they desperately try to survive.

There’s no doubt they’ll exercise that option before they go down.

It gives a government the ability to bankrupt everyone—at least those unprepared—as it goes bankrupt. "If we’re going down, we are taking you with us."

In short, that’s the government’s financial Samson Option. And they are preparing to use it soon.

What Happens Next

The last time the US government faced an imminent financial crisis was in March 2020.

At the time, it was the height of the stock market crash amid the COVID hysteria. People were panicking as they watched the market plummet, and they turned to the Fed to do something.

In a matter of days, the Fed created more dollars out of thin air than it had for the US’s nearly 250-year existence. It was an unprecedented amount of money printing that amounted to more than $4 trillion and nearly doubled the US money supply in less than a year.

For perspective, the daily economic output of all 331 million people in the US is about $58 billion.

At the push of a button, the Fed was creating more dollars out of thin air than the economic output of the entire country.

The Fed’s actions during the Covid hysteria amounted to the biggest monetary explosion that has ever occurred in the US. It’s a strong indication they won’t hesitate to use the financial Samson Option.

When the Fed initiated this program, it assured the American people its actions wouldn’t cause severe price increases. But unfortunately, it didn’t take long to prove that absurd assertion false.

As soon as rising prices became apparent, the mainstream media and Fed claimed that the inflation was only "transitory" and that there was nothing to be worried about.

Of course, they were dead wrong, and they knew it—they were gaslighting.

The truth is that inflation is out of control, and nothing can stop it.

i dispute the claim that inflation is ' out of control ' but the solutions are politically unacceptable ( suicidal to the ruling party and possibly to the opposition as well )Doug Caseys daily newsletter always gives interesting takes on events.

Hers one I found more interesting than usual.

Mick

Well, what is the latest news out of the USA?i dispute the claim that inflation is ' out of control ' but the solutions are politically unacceptable ( suicidal to the ruling party and possibly to the opposition as well )

one could always start by cutting government expenditure and waste , streamlining regulation .

well apart from unfairly singling out the US with the policy of printing currency without a parallel increase in ( actual ) productivityWell, what is the latest news out of the USA?

The 1.7 trillion Omnibus bill that has just passed congress will just increase or at best keep the velocity of money where it is.

One of the parts of the 4,000 page bill allows savers to remove their $01(K) retirement savings, and given the pressure most Americans are under, who thinks there will not be a large drain on 401(K) accounts?

Increases in funding for those who have their food stamps stolen by criminals.

Both of these will put inflationary pressure on the US economy.

Mick

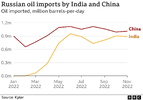

How significant is that though? Are there any graphs showing historical imports (pre-Ukraine war).Oil is back around $80, so the inflation angle is diminished.

Since Feb, Chinese imports haven't risen that much. It is India doing the importing.

View attachment 150973

The cap was only ever to be an inconvenience, and deliver less into Uncle Vlad's coffers / pockets. By way of increased insurance . The Greek shippers will continue to be involved,

i would guess ( most ) Chinese customers would lock in long term agreements/contracts ( which Russia would prefer and win in the long term ) India seems to be a big winner here maybe some others as well i never see a lot on Mongolia , which should become a rapidly developing nation .How significant is that though? Are there any graphs showing historical imports (pre-Ukraine war).

China and India would definitely be taking advantage of the low prices, but that only looks like an additional 1.5m barrels/d. Surely that'd be offset by import reductions in other countries?

The bbq chicken is so much more then everything else, or is that bbq chicken part of the fish and chips to take away?From the year the L family arrived in Oz:

The old man bought a new ute for $1700 and a pile of bricks 8km from Perth city centre for $19,500. As far as I remember average wages were about $70 pw.

View attachment 150986

I think that's for a whole chook.The bbq chicken is so much more then everything else, or is that bbq chicken part of the fish and chips to take away?

Anyway the porterhouse seems like a bargain

you are probably right ( the whole bird not one quarter of the over-fed pigeons you get today )I think that's for a whole chook.

oh i see LOTS of promising , maybe not so much delivering ( but plenty of excuses )

Nah, merely spilt a little plasma from a quick transfusion.Is there blood in the streets yet?

From the year the L family arrived in Oz:

The old man bought a new ute for $1700 and a pile of bricks 8km from Perth city centre for $19,500. As far as I remember average wages were about $70 pw.

View attachment 150986

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.