You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Joined

- 28 May 2020

- Posts

- 6,597

- Reactions

- 12,660

Quite true, but in engineering the veracity of the model, the number of variables and their value constraints are generally well known.I thought you had some sort of engineering background? I am pretty sure both practical and digital models are used to forecasting performance of structures etc.

And they hind cast well, are repeatable, and you will struggle find anyone who is skeptical about their modelling output.

Mick

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,943

- Reactions

- 13,228

A lesson in chaos...

Donald Rumsfeld encapsulated it quite succinctly (paraphrasing because I can't be bothered to look up the exact quote)

There are known knowns, that is to say there are things that we know that we know.

They are known unknowns, that is to say there are things we know that we do not know.

But then there unknown unknowns, that is to say that there are things that we don't know that we don't know.

Butterfly wings in San Francisco and tempests in Tokyo and all that shxt.

Models are dependant on the inputs, i.e. known knowns. They take no account of known unknowns or unknown unknowns.

There's nothing wrong with models, but we must acknowledge that models are... models.

Models may not reflect what happens in reality, precisely because of the nature of the systems that we are operating in, known unknowns and unknown unknowns.

No way is there a better illustration of this than weather forecasting.

Modelling gets it right a lot of the time. Sometimes a little bit wrong, other times spectacularly wrong.

Unknown unknowns etc.

Can we imagine a system so similar to weather as economics, such as it is.

For sure and certain we can pluck a forecast straight out of our @ss (your @ss, actually) and be right some the time, perhaps even a lot of the time.

Butt somewhere, those butterfly wings are flapping....

....bruh

over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,291

- Reactions

- 7,509

Jobless claims below estimates, GDP price index above estimates, so still more room to keep pumping rates from both angles, futures thus tank, growth plays thus tank the most, energy the best of all options, groundhog day.

- Joined

- 3 November 2013

- Posts

- 1,570

- Reactions

- 2,776

Everything bleeding

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,943

- Reactions

- 13,228

Head.

Nail.

Hit.

Nail.

Hit.

- Joined

- 3 May 2019

- Posts

- 6,317

- Reactions

- 9,978

Inflation lanche?

- Joined

- 20 July 2021

- Posts

- 11,671

- Reactions

- 16,259

including my left hand ( but not much ) , it could be worse ( or better if you have spare cash )Everything bleeding

- Joined

- 3 November 2013

- Posts

- 1,570

- Reactions

- 2,776

Head.

Nail.

Hit.

So what's the alternative?

Stagflation?

Hyperinflation?

Depression?

Debt is the foundation of western of economies. No debt, no productivity, no goods, no services. Unless they're planning to roll out a new world order where buttcoin can be used to pay for my lapdances, we're going to keep riding this damn rollercoaster and that means the Fed will have to pivot at some point to make debt accessible.

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,943

- Reactions

- 13,228

Well that's a complex question and probably one I am not qualified to answer... Actually, definitely not qualified to answer.So what's the alternative?

Stagflation?

Hyperinflation?

Depression?

Debt is the foundation of western of economies. No debt, no productivity, no goods, no services. Unless they're planning to roll out a new world order where buttcoin can be used to pay for my lapdances, we're going to keep riding this damn rollercoaster and that means the Fed will have to pivot at some point to make debt accessible.

It does raise more questions for me however, like who is the current system designed to serve?

Us?

Or them?

The pseudo Keynesians and ad hoc frankinomics has led us to this point. Although I think more short-term pain would be involved, the Austrians jave probably been right all along.

- Joined

- 3 November 2013

- Posts

- 1,570

- Reactions

- 2,776

Well that's a complex question and probably one I am not qualified to answer... Actually, definitely not qualified to answer.

It does raise more questions for me however, like who is the current system designed to serve?

Us?

Or them?

The pseudo Keynesians and ad hoc frankinomics has led us to this point. Although I think more short-term pain would be involved, the Austrians jave probably been right all along.

Who knows, I don't have an answer either, we're probably not going to get one on an internet forum.

The system that has been in place has meant that world has been relatively peaceful and we've had massive technological advance - that's got to count for something and it's an argument to continue with it.

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,943

- Reactions

- 13,228

For now, I'm pretty happy on Friday afternoon having a few beers and hanging out with the puppy, lots of provisions in the store room, and backup power supplies etc.Who knows, I don't have an answer either, we're probably not going to get one on an internet forum.

The system that has been in place has meant that world has been relatively peaceful and we've had massive technological advance - that's got to count for something and it's an argument to continue with it.

l will deal with the sh$t as it hits the fan as it hits it

over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,291

- Reactions

- 7,509

Fed targets inflation, not debt.

- Joined

- 20 July 2021

- Posts

- 11,671

- Reactions

- 16,259

something NASTY this way comes , they will create a definition when they can no longer deny there is a problemSo what's the alternative?

Stagflation?

Hyperinflation?

Depression?

Debt is the foundation of western of economies. No debt, no productivity, no goods, no services. Unless they're planning to roll out a new world order where buttcoin can be used to pay for my lapdances, we're going to keep riding this damn rollercoaster and that means the Fed will have to pivot at some point to make debt accessible.

i am taking a hedge by setting up goods for possible barter ( later )

- Joined

- 28 May 2020

- Posts

- 6,597

- Reactions

- 12,660

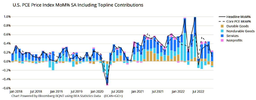

Inflation is one of those macro terms that just sometimes needs to be broken down.

From this quick graph of some of the groups that make up inflation , one might be able to draw some interesting observations.

1. For the last few moths, the cost of goods, both durable and non durable has fallen, thus bringing down one aspect of inflation.

However, the services component has been pretty consistent through this time, and seeing as the US GDP is highly service oriented, it may not fall as much as people expect.

2.Since 2018, the services component has been consistently positive, except for the covid blip in march 2020.

Durable goods were pretty much neutral from jan 2018 thru to march 2021 when they really took off.

Food for thought.

Mick

From this quick graph of some of the groups that make up inflation , one might be able to draw some interesting observations.

1. For the last few moths, the cost of goods, both durable and non durable has fallen, thus bringing down one aspect of inflation.

However, the services component has been pretty consistent through this time, and seeing as the US GDP is highly service oriented, it may not fall as much as people expect.

2.Since 2018, the services component has been consistently positive, except for the covid blip in march 2020.

Durable goods were pretty much neutral from jan 2018 thru to march 2021 when they really took off.

Food for thought.

Mick

- Joined

- 20 July 2021

- Posts

- 11,671

- Reactions

- 16,259

services ( costs ) will tend to remain high ( or go higher ) because wage rises ( labour costs ) trail CPI rises , so you traditionally end up with two issues a skilled worker shortage and demand for higher wages ( these are NOT precisely the same thing )Inflation is one of those macro terms that just sometimes needs to be broken down.

From this quick graph of some of the groups that make up inflation , one might be able to draw some interesting observations.

View attachment 150893

1. For the last few moths, the cost of goods, both durable and non durable has fallen, thus bringing down one aspect of inflation.

However, the services component has been pretty consistent through this time, and seeing as the US GDP is highly service oriented, it may not fall as much as people expect.

2.Since 2018, the services component has been consistently positive, except for the covid blip in march 2020.

Durable goods were pretty much neutral from jan 2018 thru to march 2021 when they really took off.

Food for thought.

Mick

there is sometimes a trend for the most skilled workers to strike out on their own ( sometimes poaching assistant level staff )

over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,291

- Reactions

- 7,509

China lifts the last of its curbs, oil runs more, exactly as expected.

- Joined

- 20 July 2021

- Posts

- 11,671

- Reactions

- 16,259

until the next excuse occurs , the US are addicted to sanctions and China will respond in it's own way ( it has half of Asia to develop as trading partners , now including Afghanistan )China lifts the last of its curbs, oil runs more, exactly as expected.

over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,291

- Reactions

- 7,509

>china reopens

>oil runs

>markets realise this is going to pump inflation further

>markets thus go red

>growth plays go deep into the red

>energy only green sector on the day

I am shocked I tell you, truly shocked.

>oil runs

>markets realise this is going to pump inflation further

>markets thus go red

>growth plays go deep into the red

>energy only green sector on the day

I am shocked I tell you, truly shocked.

- Joined

- 20 July 2021

- Posts

- 11,671

- Reactions

- 16,259

did you miss a ( WINK) at the end , perhaps ??>china reopens

>oil runs

>markets realise this is going to pump inflation further

>markets thus go red

>growth plays go deep into the red

>energy only green sector on the day

I am shocked I tell you, truly shocked.

slightly bemused here , but had a plan for either trend ( just in case some puppeteers still work during the Festive Season )

Similar threads

- Replies

- 1

- Views

- 972

- Replies

- 33

- Views

- 3K

- Replies

- 69

- Views

- 4K

- Replies

- 10

- Views

- 2K