- Joined

- 19 October 2005

- Posts

- 4,693

- Reactions

- 6,970

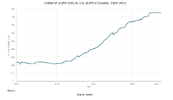

Is that a political comment?Would just like this red line to turn blue I think.

Is that a political comment?Would just like this red line to turn blue I think.

The problem with that scenario is that it assumes that everyone will just keep buying US treasuries.With Tariffs the Americans don't realise or have forgotten is that other countries will slap tariffs of their own on to American products, making inflation worse. It will probably give the US fed a headache trying to bring down inflation back to 2%.

Assuming Trump does win in November and another tariff war does start, I would avoid Gold stocks as the fed would have start to hike rates again.

while i am against tariffs , i understand the potential upside in an uncompetitive nation ( the EU achieves to same goal using subsidies and quotas , which i also dislike )The last time Trump was in power China hit back tariffs of its own against US made products. The EU was preparing to hit back with tariffs of its own against US exports as well. Neither China or the EU were going to be bullied by the Americans.

Thanks Duc.Mr GG,

The gold bull is safe and well:

View attachment 181123View attachment 181122View attachment 181121View attachment 181120View attachment 181119View attachment 181118

The West is fast losing this war. The East is rising. As evidenced by the rise in gold.

You simply cannot hold Western debt. Gold is essentially a 0% perpetual bond. It has zero counter-party risk. Obviously people need to hold cash to pay bills, have a coffee etc. After that, what is not allocated to investments, needs to be allocated to gold.

I also hold silver. Silver is a trading holding, not in the same class or category as gold.

View attachment 181125View attachment 181124

jog on

duc

i disagree , i see the US/UK/EU hegemony falling to the increasing population mass in AsiaThanks Duc.

A very interesting post.

My only point of difference with you is that I believe the USA will eventually win, but in the meantime I will enjoy the fruits of the battle.

In fact the battle and resultant turmoil may be more advantageous for the POG than the result of the BRICS / USA war.

gg

Thanks Duc.

A very interesting post.

My only point of difference with you is that I believe the USA will eventually win, but in the meantime I will enjoy the fruits of the battle.

In fact the battle and resultant turmoil may be more advantageous for the POG than the result of the BRICS / USA war.

gg

Thanks Duc and Divsie. @ducati916 @divs4everMr GG,

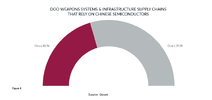

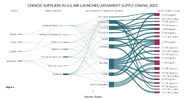

View attachment 181178View attachment 181177View attachment 181176View attachment 181175

Full: https://www.govini.com/insights/num...n-u-s-production-capacity-and-deterring-china

The US has already lost, it just doesn't know that it's already dead.

Better to accept the loss and massively reshore. Yes that will be hugely inflationary, but it is the right way to go IMO. It will also require huge increases in energy requirements.

jog on

duc

now it is an intriguing question on who 'controls' the Global economy , the City of London ( a city state in the UK ) thinks they have a fistful of leverage and so does a group of bankers based in SwitzerlandThanks Duc and Divsie. @ducati916 @divs4ever

There are many arguments pro and con the USA continuing to control world commerce via the dollar $USD.

I am in the pro camp. I guess people need to read as much as they can if it interests them, keep an open mind and not be afraid to change their opinion. They then need to use that belief whichever way it goes in investing and life for that matter. It does require wide reading and no one scholar nor article/book will be definitive.

The only other factor on your side of the argument is the recent move in the USA for a gerontocracy to have the levers of power, Biden and Trump, both old white men living their lives as if it were the 20th Century. I'd put the ascent of people like JD Vance though as a counterargument to that and also allude to Putin and Xi as not exactly being spring chickens neither.

An interesting discussion and interesting times.

gg

Thanks Duc and Divsie. @ducati916 @divs4ever

There are many arguments pro and con the USA continuing to control world commerce via the dollar $USD.

I am in the pro camp. I guess people need to read as much as they can if it interests them, keep an open mind and not be afraid to change their opinion. They then need to use that belief whichever way it goes in investing and life for that matter. It does require wide reading and no one scholar nor article/book will be definitive.

The only other factor on your side of the argument is the recent move in the USA for a gerontocracy to have the levers of power, Biden and Trump, both old white men living their lives as if it were the 20th Century. I'd put the ascent of people like JD Vance though as a counterargument to that and also allude to Putin and Xi as not exactly being spring chickens neither.

An interesting discussion and interesting times.

gg

gold v. bitcoinZero hedge recording big jump in net sales of US securities.

They see it going into bitcoin.

I would tend to disagree, I think it will continue to go into gold.

This story explains how the CCP have banned the cits from buying BTC, but there is big interest in the digital coin ETF's.

For it to be replacing the treasuries, the CCP central ban eould need to be buying the ETF's or the digi coins themselves.

Mick

View attachment 181274

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.