- Joined

- 8 June 2008

- Posts

- 13,229

- Reactions

- 19,520

Our tin roof actually are quite protective ..once you put eglass on your window, you even lose mobile reception

The more talk like that, the higher gold goes

What's going on with the post-2022 divergence between the spot gold price and the 10 Year Treasury Real Rate?

View attachment 174798

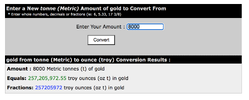

Thanks @ducati916 and other geopolitical nerds such as I. Up until recently I have felt that we have been a lonely few in our warnings re the intention of China to attempt decouple from the $USD as being the main game of the BRICS and the main chance of a gigantic change in the POG by many many times its present value.1. And WHY are CBs buying more gold? The answer is primarily energy. If you can purchase your energy (oil) in your home currency and settle in trade balances with any deficit settled in gold (gold being used as a reserve asset), then your currency is floating as to gold. Your currency then comes under your own control. No longer will your currency be inflated/deflated by the USD. No longer will you have to accumulate USD or UST. You simply accumulate gold. Your currency may inflate or deflate as against gold, but it is your choice, not the Federal Reserve or US Treasury making that choice for you.

Simply: Gold is now (or fast becoming) the oil currency. As the oil market is now some 14X larger than the gold market, that is the price differential that will close over time.

China is driving the break of oil being priced only in USD.

This week, lot's of action:

Yellen just returned from China: https://home.treasury.gov/news/press-releases/jy2232

View attachment 174777

Will China go along with this?

No chance: https://www.scmp.com/economy/china-...-avoid-cautionary-tale-japan-and-plaza-accord

View attachment 174778

So how can Yellen get a weaker USD if China will not revalue the CNY higher?

View attachment 174779

As already stated, China will not float the CNY against the USD. But China are already floating it against gold.

View attachment 174780

So if Yellen wants CNY up and USD down, all she needs to do is let the USD float FREELY against gold. This of course has not been the case:

So of course, the 'Paper Gold' market: https://reaction.life/dont-forget-the-golden-rule-whoever-has-the-gold-makes-the-rules/

View attachment 174781

The paper market was established in 1974:

View attachment 174783

However, you cannot (if you are an in-the-loop banker) let gold just run free when the banking system is short billions of USD paper gold. You have to close down unallocated paper positions.

The end of the LBMA is nigh - Research - Goldmoney

Basel 3 is on course to regulate the LBMA out of existence. And with it will go all the associated arbitrage business and position-taking on Comex, because most bullion bank trading desks will cease to exist. The only supply to buy-side speculators of gold and silver contracts will be...www.goldmoney.com

View attachment 174782

What's behind China's gold-buying spree? – DW – 04/05/2024

For more than a year, China's central bank has been buying up large amounts of gold. The move, along with the wars in Ukraine and Gaza, have helped spike the price of the precious metal to new highs.www.dw.com

Which is fine as far as it goes, but it really misses the point:

If the US cap the POG in USD terms and China lets the CNY float freely against gold, the CNY will weaken against gold, but, Chinese gold buys MORE OIL because China can settle net-net in gold for oil than does US gold, which is capped.

The above is actually China running a limited OPEN CAPITAL account.

Renminbi Usage in Cross-Border Payments: Regional Patterns and the Role of Swaps Lines and Offshore Clearing Banks

The paper examines the usage of the Renminbi (RMB) as an international payment currency. Globally, the use of RMB remains small, accounting for 2 percent of total cross-border transactions. Using country-level transaction data from Swift** for 2010–21, we find significant regional variations in...www.imf.org

View attachment 174784

Now these locations have CNY clearing facilities and major gold trading hubs.

View attachment 174785

Voila...you have a limited open capital account.

2. The smaller BRICs are doing EXACTLY the same thing. Buying oil in their home currency and settling net-net in gold. Their currencies then weaken as against gold. Their Central Banks are buying gold. All will eventually capitulate and buy gold to buy oil. Japan will likely be next. If/when they do, that's it, the US will have to capitulate also.

3. This really depends on whether retail adopt silver as a poor man's gold to exit their countries fiat currency. China and India will do so I think, they have that recent and current history. The West has forgotten. Possibly it wakes up. A higher silver price is actually far more dangerous than a high gold price. Silver has a far wider industrial use. A significantly higher silver price has economic consequences. Gold never lost its monetary use. Silver did. If silver rediscovers its monetary heritage, watch out.

So in a 4 sentence summary:

Gold is now an oil currency.

The world economy cannot handle $100 oil, millions would starve to death.

The world will not even blink at $10K gold, gold has no other uses.

With a higher POG the POO falls in fiat terms.

jog on

duc

1. Thanks @ducati916 and other geopolitical nerds such as I. Up until recently I have felt that we have been a lonely few in our warnings re the intention of China to attempt decouple from the $USD as being the main game of the BRICS and the main chance of a gigantic change in the POG by many many times its present value.

2. I am not however as positive as you that the Chinese will pull it off and decouple Gold, Oil and other Commodities from being traded in Bricsies rather than $USD. The US have a strangle hold not only on Commodities but also on Swift, US, European and Middle Eastern banks, and the ability to blackmail any bank anywhere in to toeing the line on the USD exchange rate for any and all currencies. This is done by legal and illegal means using sophisticated spycraft, diplomacy and espionage via eavesdropping similar to that exposed by Edward Snowden.

3. This is not to say that Gold will not multiply by some amount in the low teens to x20 times in value over the next 10 years but that it will not multiply by a factor of some hundreds.

gg

The Chinese people certainly have been buying gold, creating traffic jams at the Shuibei jewellery hub. Precious metal is the only refuge from the property crash and the slump on the Shanghai bourse. Tightening capital controls make it hard to smuggle serious sums abroad.There is a strong suspicion among gold experts that China is behind the surge in buying, building up a war-fighting bullion chest.

City prophetising $USD3000 for Gold in 2025. Ern Hoffman cryto and market reporter for Kitco has been following the POG closely and gives a good summary of Kitco' and Citi's outlook for Gold. It is pretty much in line with the posts over the past 12 mo. from the Gold bulls in this thread on ASF.

gg

Looks like the $2400 ish zone is a psychological level to get over on it's way to $3000. Some healthy short term consolidation but there might be a more sustained sideways chop until it springs out. Could be forming a flag between 3400-3900 ish. On the downside, decent support is a long way away.

Who is the ‘massive player with deep pockets’ behind gold’s surge?

by Ambrose Evans-Pritchard

Looks like the $2400 ish zone is a psychological level to get over on it's way to $3000. Some healthy short term consolidation but there might be a more sustained sideways chop until it springs out. Could be forming a flag between 3400-3900 ish. On the downside, decent support is a long way away.

View attachment 175116

I think I said I wish I had bought more Kangaroos when AUD Gold was below $3000 and didn't chase it after $3200.Someone was smart enough to say you will wish you bought more at $3200...

View attachment 175117

That's exactly the type of verbal mistake I often make.Woops, I meant potential 2340-2390 flag

Hi @Dona Ferentesalways like his stuff. thanks for posting

"Gold is the hedge against dystopia"

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.