- Joined

- 13 February 2006

- Posts

- 5,261

- Reactions

- 12,111

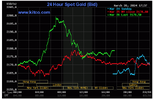

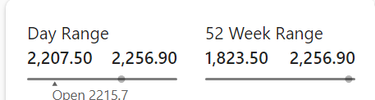

So gold:

When the West controlled the gold price via paper gold, gold tracked TIPS. No longer. Control has shifted to the East as physical is drained. The reason is clear and will form the conclusion.

GLD moving higher in price, while reducing its actual holdings of unallocated physical. Does that have anything to do with JPM becoming custodian and shifting physical gold from London (LBMA) to New York?

Of course we will have YCC. The ISDA that is waiting to be approved is QE. QE = YCC.

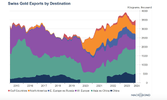

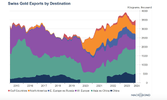

The Gulf states are now accumulating gold.

Of course they are. Gold is now the world reserve asset for oil purchases. This is the driving force in the rise of the POG (physical). It will not abate.

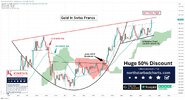

Because the US MUST move to YCC (QE) to retain some form of solvency to protect the UST market, they must sacrifice the USD. The chart above demonstrates the last YCC and just how successful it was. That playbook is back.

OPEC+ is wide awake to this fact. Hence gold is now the settlement asset after netting out trade balances.

It looks very suspiciously that Japan is the latest sovereign to break ranks and buy oil in Yen and settle in gold. Charts later in the week.

jog on

duc

When the West controlled the gold price via paper gold, gold tracked TIPS. No longer. Control has shifted to the East as physical is drained. The reason is clear and will form the conclusion.

GLD moving higher in price, while reducing its actual holdings of unallocated physical. Does that have anything to do with JPM becoming custodian and shifting physical gold from London (LBMA) to New York?

Of course we will have YCC. The ISDA that is waiting to be approved is QE. QE = YCC.

The Gulf states are now accumulating gold.

Of course they are. Gold is now the world reserve asset for oil purchases. This is the driving force in the rise of the POG (physical). It will not abate.

Because the US MUST move to YCC (QE) to retain some form of solvency to protect the UST market, they must sacrifice the USD. The chart above demonstrates the last YCC and just how successful it was. That playbook is back.

OPEC+ is wide awake to this fact. Hence gold is now the settlement asset after netting out trade balances.

It looks very suspiciously that Japan is the latest sovereign to break ranks and buy oil in Yen and settle in gold. Charts later in the week.

jog on

duc