- Joined

- 25 July 2021

- Posts

- 875

- Reactions

- 2,215

Gold Is Soaring... But Miners Are Struggling |

By Vic Lederman, editorial director, Chaikin Analytics |

Folks, it's finally happening...

Gold prices are soaring.

Now, if you're like me, you probably remember all the talk about gold during the peak of the COVID-19 pandemic. After all, it was obvious we were entering an inflationary period.

And just about everyone knows the refrain – "gold is an inflation hedge."

But gold prices stayed stubbornly range-bound. Or in more simple terms, gold traded mostly sideways.

Now, that's changing. Gold prices have been on a tear recently. And they just hit a new all-time high.

One ounce of gold is currently trading for about $2,160. That's roughly $100 more per ounce than the 2020 peak.

But this change in momentum hasn't made its way to gold miners. In fact, gold miners are down about 19% from their 2023 peak.

So today, let's take a closer look through the lens of the Power Gauge...

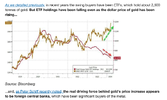

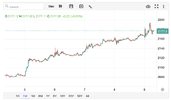

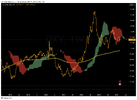

| We'll start by looking at SPDR Gold Shares (GLD). It's an exchange-traded fund ("ETF") that first listed in 2004. And it has traded on the New York Stock Exchange since 2007. Today, GLD is the largest physically backed gold ETF in the world. It currently holds more than 26 million ounces of gold bullion worth roughly $56 million. Keep in mind that GLD doesn't earn a Power Gauge rating. But there's still a lot we can learn about the ETF in our system. Take a look at this chart... |

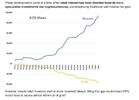

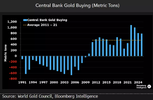

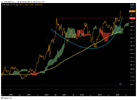

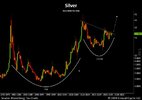

| First, notice the dashed line across the top. That's where gold prices peaked in 2020. We can clearly see on the chart that the new high is a major change in momentum. But that doesn't mean that gold is outperforming other assets. The red and green bar in the panel below the price chart shows us GLD's relative strength against the S&P 500 Index. And once again, it's clear – gold has unperformed stocks for the majority of the past five years. That's true even when you take the recent big move up into account. Now, you might think that the big upward move would translate into major gains for gold miners. But that's not the case. This time, we can use the Power Gauge to take an even deeper look – using the VanEck Gold Miners Fund (GDX). This ETF holds a basket of companies involved in the gold mining industry. Right now in the Power Gauge, the fund itself holds a "very bearish" rating." And out of its 29 holdings with ratings in our system, none of them earn a "bullish" or better ranking. Seventeen are "neutral" and 12 are "bearish" or worse. As you would expect, that translates to terrible performance on the chart... |

| Once again, I've added a dashed line at the 2020 peak. It makes it easy to see the dramatic downturn that gold miners are experiencing. You can also see that the fund's relative strength versus the market is similarly abysmal. So it's likely you will have seen stories in the news about soaring gold prices. And you might even consider picking up a gold mining stock or two. Well, the Power Gauge is clear... Things are looking a little better for gold prices. But this industry hasn't turned the corner yet. Personally, I'll be watching gold miners closely for a turnaround. Soaring gold prices could signal a big move is in the making. But today's "very bearish" Power Gauge rating for miners means that it's time to wait and see. Good investing, Vic Lederman |