Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,364

- Reactions

- 9,520

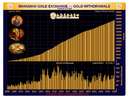

IMO from a technical POV gold is not showing any strong directional bias at the moment, but it does have a very short term weak directional bias to the upside. Still waiting for gold to show it"s hand.What do you make of this non=sense. Is Gold getting ready to fall?

Gold analysis: US dollar bounces back as yields rise on firmer US data

Opportunity cost of holding gold rises with yields climbing and amid a racier US equity market

Gold technical analysis suggests a potential break below $2015 could initiate renewed selling pressure

View attachment 171527

As we move through the year, it's likely that inflation pressures will ease up globally, possibly kicking off a round of interest rate cuts. The ECB, BoE, and Fed are expected to start this process around mid-year, depending on how the data unfolds. Looking back at how gold prices shot up in anticipation of rate cuts in 2023, we could see some big gains in 2024 once central banks actually start easing up and yields drop again. But that could be months away, which gives gold bears plenty of time to potentially slam it down.

There's undoubtedly demand for gold, partly because inflation has been sticking around and fiat currencies have been losing value. Gold, often seen as a safe haven asset and a hedge against inflation, might get a boost even before the rate cuts actually happen, as markets tend to predict future moves. But in the short term, it's likely we'll see some more settling down and maybe a slight dip

@rcw1 Waiting with bated breath for the report card.Good morning champions,

Gold is good . The more one tells oneself the same story over and over again, one believes ha ha habelief .,,, how could one not??

Hoping to find more gold in the form of salutes in Cairns today. Slow track … gold gunna be hard to get.

Good fortune everyone.

Kind regards

rcw1

@rcw1 Waiting with bated breath for the report card.

Bovines to feed a joint fence the mongrel neighbour doesn't want to know about, so muggins here will finish it today. Hey its morning tea time.farmerge, rcw1 favourite former Commsec member …

Muggy as … hot and humid …

The hotter the better …

Each to our own.

Slight breeze helping dry out the track .. oh look heaven forbid it’s Beer oclock. Ha ha ha

Gold is good. Bring on a prosperous Monday bloke …. Need to discuss with the goog the flies STX prophecies rcw1 second favourite former COMMSEC Member.

Have a good day farmerge and don’t work to hard … it’s Sunday apparently

Kind regards

rcw1

Good morning gold lovers,

Gold is good

Record highs US $2128.40 !!! where to now????

Holding physical and loving it.

Have a very nice day, today

Kind regards

rcw1

I put a couple of pitchforks on the GLD chart, light blue showing the move up and pink showing the move down. This last week GLD has broken out the top of the down pitchfork supporting the continuation of the up move. Price is now back at the top resistance zone of the big pattern.

View attachment 172000

On the daily chart we can see that the last day of the week was the breakout day from the down pitchfork which happened on better than average volume. Considering the pattern of this last up-move from the 5th Oct low being a move up then sideways and now continuing in the direction of the up pitchfork, this all supports the chance for this up-move to be the one that can break out of the big pattern. March could be the month that it happens and the next two weeks should very interesting for gold.

View attachment 172004

Nah - it's just another "Long Neck Chart" - bloody things are multiplying..

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.