Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,360

- Reactions

- 11,711

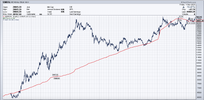

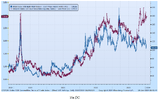

Have we started a new phase of gold pricing above $2030 ish, the old weekly high? This looks like it will be three weeks above. JPM might have gone long. Not counting my kangaroos on that huge C&H that's been discussed for some time, but maybe.

View attachment 167969

This weekly close is holding, for now. Still not counting my kangaroos, but with the Houthis (Iran) being struck it seems inevitable that the ME conflict is going to widen further unless common sense prevails. Add in China about to go berserk over Formosa democratic elections and there's plenty of kindling to cause a flight to safety haven assets. If, and only if, this higher level remains a support then we're potentially looking at a break out from the giant C&H prophesied many moons ago. Or, this TA stuff is BS.