Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,360

- Reactions

- 11,711

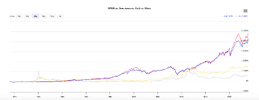

@ducati916 the only problem with this chart is the time period. Is this time period relevant in any way to what is happening now? If I start this chart from the 2011 high in Gold then the chart will look completely different, example below;View attachment 168335

Twenty-First Century Fox: DJCI Gold Tops Stocks and Bonds This Century – Indexology® Blog | S&P Dow Jones Indices

Get insights on trending investment themes from industry thought leaders on the Indexology® blog from S&P Dow Jones Indices.www.indexologyblog.com

jog on

duc

@ducati916 the only problem with this chart is the time period. Is this time period relevant in any way to what is happening now? If I start this chart from the 2011 high in Gold then the chart will look completely different, example below;

View attachment 168377

This is my thinking as well, but I rely on the current charts to confirm or disprove what I think is happening. So far the charts are confirming the look of a new bull market.Possibly, we are on the brink of a huge bull market.

Updating with new data this week, the market has come back to the trendline and 0.618 fib and is losing momentum on the daily timeframe. I looking to see if momentum to the upside starts to come back or continues to fade.It's no secret that gold is currently trading in the resistance zone at the top of a multi-year sideways pattern, we've all been talking about this pattern for a while now. The run up to the zone, this time round, has looked very bullish and the question that we all ask ourselves is 'will it break through on this latest charge at the zone?' To me it looks like it's having a pullback on the daily time frame but the weekly and monthly time frames still look bullish.

View attachment 168058

So at the moment I'm looking at possible pullback levels that would still look bullish on a weekly time frame. I've put a fib fan and a trendline on the daily chart below and you can see that the trendline lines up exactly with the 0.618 time%price retracement line. I definitely want to see the market turn back up at or above this line, but to be honest I will be closely re-assessing the situation if the retracement breaks below the 50% time&price line (blue line).

View attachment 168059

Dec 21, 2023

Buckle up for a riveting ride with Eric Sprott, our community's financial luminary, as he tackles inflation, naked shorting, interest rates, and the precious metals market. Joined by host Craig Hemke, they not only dissect today's financial landscape but also serve up a tantalizing preview of what's in store for 2024, offering essential insights for navigating the economic rollercoaster ahead.

Eric Sprott on Gold Price in 2024

Yearly Wrap-Up Report

I genuinely would not be surprised, even if California has crazy prices (vs the rest of the US) and penthouses in NYC are sky high, there are many not to say most areas where houses are cheap especially compared to Australia and they are also much bigger nowadays.

This looks like US prices, be interesting to see the same chart using gold in AUD versus AUD house prices.

Me also.gold in AUD versus AUD house prices.

That is data treasure .After a bit of searching I found this.

Not quite what I wanted, and it is Sydney centric.

View attachment 168599

And heres another one which might be all of Australia rather than just Sydney and is a bit out of date.

View attachment 168600

Mick

a little difficult to judge , you had the fittings and workmanship on 50 years back vs. the modern bling and 'safety ' of a modern residence maybe shrinkflation has attacked housing as well ( but not always on actual floor-space )

yes , but building durability started to slide markedly from the '70s until now ( i have lived in several homes erected it the '70's and time does not always treat them kindly )I genuinely would not be surprised, even if California has crazy prices (vs the rest of the US) and penthouses in NYC are sky high, there are many not to say most areas where houses are cheap especially compared to Australia and they are also much bigger nowadays.

A house of the 1970s in very good nick but maybe with only one bathroom can be purchased for very cheap in most of the states from what I can see in the various House Hunters shows

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.