Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,359

- Reactions

- 11,710

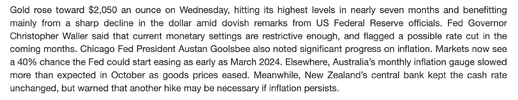

While one cannot predict the future, my belief is that the POG will move forward from here, in a gradual fashion up through $USD 2100 without there being a significant event to signal a breakthrough.

There would appear to be sufficient long term fundamental factors as quoted above to justify this opinion.

Another more important question would be, why or what would cause the POG to retreat?

gg

Significant USD weakness may be a catalyst and vice versa.

Technically, if those resistance / ATH levels mentioned above are broken then we may have a case of FOMO that could potentially result in the start of the break up from the long term C&H I've been waiting two years for...