Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,242

- Reactions

- 11,468

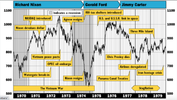

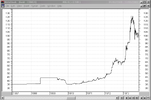

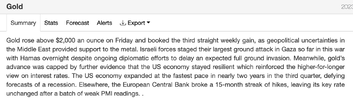

This war premium has legs. Looks like it’s just getting started too. I have a feeling the US and Israel are looking for an excuse to do some damage to Iran. France, UK and Germany seem to be signed up as well. Gunna get ugly. Worst case scenario is China taking advantage to take Taiwan. Gold could go ballistic.