- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

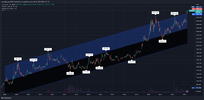

Reckon the next 'upcoming 4th attempt' by Gold clearing US $2K level & actually staying above $2K - will succeed/see Gold power on higher imo never to look back.Gold looks good on the chart with a bullish flag formation. If clears to the upside next target could be at the all-time-high blue-sky territory...

View attachment 155299

There usually is not a "fourth attempt" in charting.Reckon the next 'upcoming 4th attempt' by Gold clearing US $2K level & actually staying above $2K - will succeed/see Gold power on higher imo never to look back.

Gold looks good on the chart with a bullish flag formation. If clears to the upside next target could be at the all-time-high blue-sky territory...

View attachment 155299

The way I see it... the more attempts Gold makes trying to crack US $2K+ level - then the weaker resistance becomes at that level imo (my thought process anyway)Definitely a bullish flag/pennant but as GG said, how many attempts and failures at a particular level means the probability of a break up is low? Or, is it actually high? Dunno.

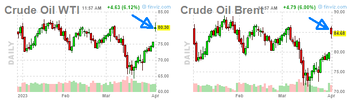

I know this is not the Black Gold thread, but your timing is immaculate for a big gap up...The environment in which we live in is too unpredictable. Unless there's more fear, where to gold? Too unpredictable for me to predict one way or another........can only watch and hope to do the right thing (partial to black gold at the moment)

Gold surging now at US $2,042 / AUD $3,002Looks like the breakout is happening...

So is 2k cleared in US$ or will it re-trace ?

View attachment 155382

(above chart is weekly data)

(above chart is weekly data)Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.