Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,379

- Reactions

- 11,749

Your kangaroos are on the fence, SeanMy Kangaroos have jumped the fence along with PMGOLD long term.

It's a shame our ASX AUD gold equities aren't following suite, but that's the nature of the beast I suppose.

View attachment 154991

Codan thread, too$240k gold nugget found in Victoria

'The wife is going to be happy': $240,000 gold nugget found

www.9news.com.au

Damn, I lost one over near St Arnaud a few years back. I wonder if could be mine?$240k gold nugget found in Victoria

'The wife is going to be happy': $240,000 gold nugget found

www.9news.com.au

Or rather there is not much visibly happening.Not much happening

Good reply.Or rather there is not much visibly happening.

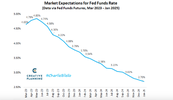

Gold needs another crisis to push through 2000 and stay there, maybe central bank stuffing up big time or a hard landing. There isn’t enough fear in the market yet. My NST holding pays dividends so I’ll just be patient and hold.Well, looks like $2000-75 is the USD Great Wall of Gold Price, never to be breached. How many times can it run up to that level and retreat before gold bugs give up? Maybe there needs to be a shake out with a significant price drop so a bunch of new players get on board and can will it through. Or, does it take another crisis and major shift from instos to move out of general equities to PMs? Can there be a bigger crisis than Covid, war in Europe, rapid inflation, interest rates and major recession? I watched a Rick Rule video a while ago and he lamented that the total % of investment by the general market in PMs was about 1% when the historical mean was closer to 2.5-3%, so if we just go back to mean it should result in double the current demand and presumably major increase in price. Or, there's a new mean level of investment... Oh well, still holding on and will be adding on the dips.

Well, looks like $2000-75 is the USD Great Wall of Gold Price, never to be breached. How many times can it run up to that level and retreat before gold bugs give up? Maybe there needs to be a shake out with a significant price drop so a bunch of new players get on board and can will it through. Or, does it take another crisis and major shift from instos to move out of general equities to PMs? Can there be a bigger crisis than Covid, war in Europe, rapid inflation, interest rates and major recession? I watched a Rick Rule video a while ago and he lamented that the total % of investment by the general market in PMs was about 1% when the historical mean was closer to 2.5-3%, so if we just go back to mean it should result in double the current demand and presumably major increase in price. Or, there's a new mean level of investment... Oh well, still holding on and will be adding on the dips.

Good reply.

My 3 word entry, composed on my phone when out on a walk and without my glasses, was to achieve several goals.

Trivially, to push that stupid Russian market thread off the front page.

Meaningfully, to redirect the conversation away from MSM stereotypical reporting of a nugget find.

Importantly, AUD up a tad and gold down in N.Y.... not indicative of a strong local opening.

Subtextually, it is a quiet period. Lull before the storm, or between waves that are washing over.

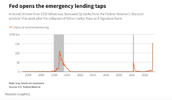

Waiting for...

... next bank to buckle, geopolitical realignments, Ukraine counter-offensive success;, many things are bubbling under, as you say.

Thanks everyone. I believe these 3 posts encapsulate most non dart throwers feelings on the POG.Gold needs another crisis to push through 2000 and stay there, maybe central bank stuffing up big time or a hard landing. There isn’t enough fear in the market yet. My NST holding pays dividends so I’ll just be patient and hold.

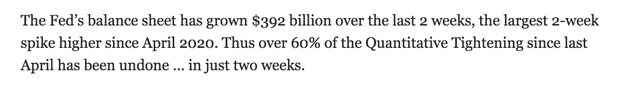

Good graphs Thanks.View attachment 155081

Gold is nobodies liability.

BTC relies upon the BTC Miners to maintain and operate the block chain. That is a liability.

jog on

duc

Good graphs Thanks.

China knows when to buy Gold.

Just a number of observations in and outside your post @ducati916

- Both Japan and China are looking at blockchain and stablecoin government run.

- The recent push towards $USD2000 has been due to short covering not intrinsic demand.

- Nobody really knows where the Fed and other Governments are going with interest rates.

- The demand for Gold long is less than it was last time Gold tried to breach $USD2000.

So it remains interesting for Gold bugs as to where it is going. As I've said before I'm a buyer at less than USD1840. This is complicated by my cash being in $AUD but I find it distracting to follow $AUD price. Perhaps I'm wrong?

gg

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.