Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,775

- Reactions

- 10,534

All the posts where people discuss their piles, breakfasts, interests of no interest to me usually clog up the FMG thread.So what does FMG stand for, F$#@ Me Garpal??

Mick

They have now migrated to this Gold thread.

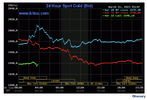

I believe my right big toenail needs trimming and that Gold is headed under $USD1900 tonight.

gg