You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

- Joined

- 29 January 2006

- Posts

- 7,217

- Reactions

- 4,439

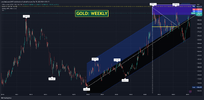

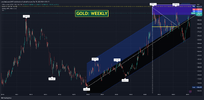

A nice end to the week, so where are we?

Firmly in the mid-channel of a 7-year uptrend.

What makes the present situation different from the 2011 peak?

First, the 2011 peak broke strongly down after 14 months while currently we are breaking strongly upwards after 30 months.

Secondly, and more importantly, all the ingredients that typically propel or keep gold high are not just in place, but appear not to be ending any time soon.

I am sure others will post POG in AUD to show we are AU$100 above POG's previous peak and a mere AU$33 off $3k/oz.

I dare say our AUD exposed goldies will see i nice jump on Monday, and enjoy a nice 2nd half boost to their financial coffers.

Firmly in the mid-channel of a 7-year uptrend.

What makes the present situation different from the 2011 peak?

First, the 2011 peak broke strongly down after 14 months while currently we are breaking strongly upwards after 30 months.

Secondly, and more importantly, all the ingredients that typically propel or keep gold high are not just in place, but appear not to be ending any time soon.

I am sure others will post POG in AUD to show we are AU$100 above POG's previous peak and a mere AU$33 off $3k/oz.

I dare say our AUD exposed goldies will see i nice jump on Monday, and enjoy a nice 2nd half boost to their financial coffers.

Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,553

- Reactions

- 22,577

China’s central bank has again added to its holdings of the metal in February – when global prices dipped well under $US1,900 an ounce – to pick up around 25 tonnes.

It was the third purchase in four months by the People’s Bank of China which this week saw its head, Governor Yi Gang, retained for another five years.

February’s purchase follows about 32 tonnes of gold added in November, the first officially recorded increase since September 2019.

By the end of February, China’s total gold reserves rose to around 2,050.34 tonnes, PBOC data showed.

The 25 tonnes bought last month was almost as much as the 31 tonnes in total that central banks picked up in January, according to the World Gold Council.

Talking about the February purchase, vice-president of the China Foreign Exchange Investment Research Institute Zhao Qingming said gold plays an important part in central banks’ international reserves management. The US, Germany and Italy, among others, hold large stockpiles of gold reserves and lead other countries by a considerable margin.

“Compared with them, China’s gold reserves remain at a modest level while foreign exchange reserves take the lion’s share,” he was quoted as saying by state media.

He made the added point that the recent moderate increases will help optimise the country’s international reserves portfolio and make it more resilient amid growing uncertainties and volatility both on the geopolitical and macroeconomic fronts.

By the end of January, China had the world’s seventh-largest official national gold reserves, according to the World Gold Council data.

It was the third purchase in four months by the People’s Bank of China which this week saw its head, Governor Yi Gang, retained for another five years.

February’s purchase follows about 32 tonnes of gold added in November, the first officially recorded increase since September 2019.

By the end of February, China’s total gold reserves rose to around 2,050.34 tonnes, PBOC data showed.

The 25 tonnes bought last month was almost as much as the 31 tonnes in total that central banks picked up in January, according to the World Gold Council.

Talking about the February purchase, vice-president of the China Foreign Exchange Investment Research Institute Zhao Qingming said gold plays an important part in central banks’ international reserves management. The US, Germany and Italy, among others, hold large stockpiles of gold reserves and lead other countries by a considerable margin.

“Compared with them, China’s gold reserves remain at a modest level while foreign exchange reserves take the lion’s share,” he was quoted as saying by state media.

He made the added point that the recent moderate increases will help optimise the country’s international reserves portfolio and make it more resilient amid growing uncertainties and volatility both on the geopolitical and macroeconomic fronts.

By the end of January, China had the world’s seventh-largest official national gold reserves, according to the World Gold Council data.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,384

- Reactions

- 11,755

I thought POG would pause at $1800, but not this. $1950 has been claimed to be a key TA breakout point by some on Kitko. Wyckoff has April gold resistance a bit higher, which has also been broken. For now. Looks like a pretty wild jump. Hopefully our goldies jump on Monday.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,384

- Reactions

- 11,755

China’s central bank has again added to its holdings of the metal in February – when global prices dipped well under $US1,900 an ounce – to pick up around 25 tonnes.

It was the third purchase in four months by the People’s Bank of China which this week saw its head, Governor Yi Gang, retained for another five years.

February’s purchase follows about 32 tonnes of gold added in November, the first officially recorded increase since September 2019.

By the end of February, China’s total gold reserves rose to around 2,050.34 tonnes, PBOC data showed.

The 25 tonnes bought last month was almost as much as the 31 tonnes in total that central banks picked up in January, according to the World Gold Council.

Talking about the February purchase, vice-president of the China Foreign Exchange Investment Research Institute Zhao Qingming said gold plays an important part in central banks’ international reserves management. The US, Germany and Italy, among others, hold large stockpiles of gold reserves and lead other countries by a considerable margin.

“Compared with them, China’s gold reserves remain at a modest level while foreign exchange reserves take the lion’s share,” he was quoted as saying by state media.

He made the added point that the recent moderate increases will help optimise the country’s international reserves portfolio and make it more resilient amid growing uncertainties and volatility both on the geopolitical and macroeconomic fronts.

By the end of January, China had the world’s seventh-largest official national gold reserves, according to the World Gold Council data.

It's almost like they're preparing for something.

- Joined

- 8 June 2008

- Posts

- 13,240

- Reactions

- 19,542

week end is coming/on us and that is when Feds release whatever earthshaking announcement..seizure, trading halts whateverIt's almost like they're preparing for something.

Gold was good this week another $6k paper last night

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,384

- Reactions

- 11,755

week end is coming/on us and that is when Feds release whatever earthshaking announcement..seizure, trading halts whatever

Gold was good this week another $6k paper last night

It's the only thing saving my portfolio at the moment. Not sure if this is a short term thing or a breakout. I thought breakout last year and doubled gold holdings. Bought some more around the bottom but not much, so still around even on gold at the moment. I'll be a happy camper if it eventually gets to that $2700 ish C&H long term target.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,384

- Reactions

- 11,755

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,384

- Reactions

- 11,755

- Joined

- 28 May 2020

- Posts

- 6,706

- Reactions

- 12,874

Sell your gold on Monday and wait for the inevitable pull back. to buy it back cheaper.

Too much manipulation for there not to be another sucker crunch.

mick

Too much manipulation for there not to be another sucker crunch.

mick

- Joined

- 13 February 2006

- Posts

- 5,267

- Reactions

- 12,127

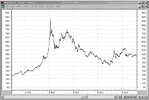

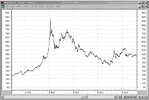

Some 7yr periods

Odds on US 10yr reaching 16%?

Assuming you got in around $1600 (the average cost of production) and Central Banks buying heavily every-time price hits the $1800 mark, what sort of pullback, assuming there is one, would make it worthwhile losing your position even in the paper market.

If you are holding physical, even more reason to hold.

jog on

duc

Odds on US 10yr reaching 16%?

Assuming you got in around $1600 (the average cost of production) and Central Banks buying heavily every-time price hits the $1800 mark, what sort of pullback, assuming there is one, would make it worthwhile losing your position even in the paper market.

If you are holding physical, even more reason to hold.

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,267

- Reactions

- 12,127

Why would you favour gold over BTC?

Essentially the answer lies in the following question:

With the Fed's BTFP facility in place (Buy the f***ing paper) we have an implicit pivot via YCC.

As a result the market has called the pivot:

In over 40yrs the Fed has never hiked rates when the 2yr is below the FFR. Mr Gundlach harps on about this constantly.

The YCC which targets the Par value of UST is an implicit pivot (agreed) but it is not explicit. In other words, a 'normal' YCC targets X% as a yield that cannot be exceeded. By targeting Par value, in theory, the Fed could raise rates because all they need to do is make UST whole to Par value. Any FFR could therefore be in place.

BTC is running because it is a risk asset. Risk assets (Tech) are running because the market has called the pivot.

Gold is running because it is a safe haven.

There is a dichotomy here. It will only be solved once the FOMC meets and Powell speaks.

The probabilities favour the pivot. Sitting as tail risk is that Mr Powell has other ideas.

The implicit pivot is only for US banks and foreign banks with a US branch.

This of course makes the US inflationary and non-US deflationary. What happens there? With the USD weaponised all the 'rules' are different.

More questions than answers.

jog on

duc

Essentially the answer lies in the following question:

With the Fed's BTFP facility in place (Buy the f***ing paper) we have an implicit pivot via YCC.

As a result the market has called the pivot:

In over 40yrs the Fed has never hiked rates when the 2yr is below the FFR. Mr Gundlach harps on about this constantly.

The YCC which targets the Par value of UST is an implicit pivot (agreed) but it is not explicit. In other words, a 'normal' YCC targets X% as a yield that cannot be exceeded. By targeting Par value, in theory, the Fed could raise rates because all they need to do is make UST whole to Par value. Any FFR could therefore be in place.

BTC is running because it is a risk asset. Risk assets (Tech) are running because the market has called the pivot.

Gold is running because it is a safe haven.

There is a dichotomy here. It will only be solved once the FOMC meets and Powell speaks.

The probabilities favour the pivot. Sitting as tail risk is that Mr Powell has other ideas.

The implicit pivot is only for US banks and foreign banks with a US branch.

This of course makes the US inflationary and non-US deflationary. What happens there? With the USD weaponised all the 'rules' are different.

More questions than answers.

jog on

duc

- Joined

- 25 July 2021

- Posts

- 875

- Reactions

- 2,215

I see what Mick is seeing, this latest move up has been too fast, too great a move in too little time, so it can't keep rising at this rate, it must at least pause. On the other hand I also see what the Duke (@ducati916 ) is saying;Sell your gold on Monday and wait for the inevitable pull back. to buy it back cheaper.

Too much manipulation for there not to be another sucker crunch.

mick

The market looks strong to me, a strong move, so yeah I'm expecting a pause or pullback at resistance but I agree with the Duke, I think it will push through. At this point I wouldn't be surprised to see another day up before pulling back but we can never know exactly what is going to happen can we.Assuming you got in around $1600 (the average cost of production) and Central Banks buying heavily every-time price hits the $1800 mark, what sort of pullback, assuming there is one, would make it worthwhile losing your position even in the paper market.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,384

- Reactions

- 11,755

I see what Mick is seeing, this latest move up has been too fast, too great a move in too little time, so it can't keep rising at this rate, it must at least pause. On the other hand I also see what the Duke (@ducati916 ) is saying;

The market looks strong to me, a strong move, so yeah I'm expecting a pause or pullback at resistance but I agree with the Duke, I think it will push through. At this point I wouldn't be surprised to see another day up before pulling back but we can never know exactly what is going to happen can we.

Agree with you guys - too hard, too fast. There is bound to be some profit taking. Happy for some consolidation over some support. Not selling though. I might unload some at $2700.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,384

- Reactions

- 11,755

AUD Gold to reach $3,500+ within a couple of month's time imo

LOL. I think USD $2700 based on the basic TA set up which has been discussed in here for some time, but not sure of the time frame. Might be a couple of years. Translating that into AUD will depend a lot on exchange rates. There's going to be lots of chop over the next year or so with everything going on in the World. Let's check back in two months.

Good evening

Believe that the PoG will continue to rise. Needs to spend time up into the over $2K US consistently. Probably the scene is set for this to happen, now, in rcw1 lifetime....

@Telamelo hope so bloke... rcw1 even happy to wait abit longer for that to click over

edit a spelling mistake

Kind regards

rcw1

Believe that the PoG will continue to rise. Needs to spend time up into the over $2K US consistently. Probably the scene is set for this to happen, now, in rcw1 lifetime....

@Telamelo hope so bloke... rcw1 even happy to wait abit longer for that to click over

AUD Gold to reach $3,500+ within a couple of month's time imo

edit a spelling mistake

Kind regards

rcw1

Similar threads

- Replies

- 1

- Views

- 531

- Replies

- 171

- Views

- 10K

- Replies

- 7

- Views

- 2K