I had great difficulty trying to gauge the direction of gold the last couple of days. EVN, NST and NCM held up well even though our dollar was down today....had me wondering if punters are thinking if the Greenback is getting weaker? Doesn't make sense if this is the case cos if US continues to put up interest rates, the Greenback will be stronger. Maybe our latest interest rates raise last week is good news for our dollar?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

- Joined

- 13 February 2006

- Posts

- 5,261

- Reactions

- 12,111

I suppose it really depends on your timeframe, but gold is going higher. Much higher. How much higher 15X.

Why?

Oil since August 1971 has been priced in USD, which were then recycled in USTs. Mr Putin has weaponised oil. Oil for Rubles or gold. This has necessitated a response from the rest of the world to sell USTs to obtain oil from OPEC. Oil of course is a currency. The most important currency.

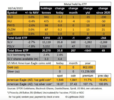

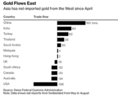

And they are buying:

Gold with what is left over after buying oil.

Gold will become the floating neutral reserve asset of the world, replacing USD. The oil market is 15X larger than the gold market after 50yrs of being suppressed by the US and UK via COMEX and LBMA. Therefore gold will revalue 15X at current oil market capitalisation to provide that reserve asset to transact in oil.

The US are seeking to sue OPEC for reducing production:

Any doubt about the cohesion of OPEC+ was put to bed this week as the group’s summit in Vienna ended with a 2 million bpd production cut. This cut appears to have achieved exactly what the participating members wanted, namely higher oil prices. It appears that fears of a global economic slowdown have taken a back seat to oil market fundamentals and geopolitical uncertainty. Saudi Arabia, the country that will spearhead the production cuts (Russia is already producing at its decreased target), has put the Biden Administration between a rock and a hard place only several weeks before the midterm elections. Confronted with the prospect of rising gasoline prices, the White House needs to react swiftly if it does not want to be seen as weak.

White House Mulls Antitrust Case Against OPEC+. On the back of the OPEC+ 2 million bpd production cut, the Biden Administration threatened to trigger anti-trust action against the alliance, with legal committees in both chambers of Congress approving legislation that would allow the White House to do so.

ETFs such as GLD et al will settle in cash. Their prospectus(s) contractually allow this. Emulate the Central Banks: buy physical gold/silver. You will not be settled in gold by many of the ETFs. PHYS will (to date) but everything else is suspect until proven. By the time that you require proof, it may be too late.

Also, it looks very much like 'Operation Twist' (to address illiquidity in the Treasury market) may be turned back on. Watch this space. That is then a return to a secular inflation. A 1970's rerun is upon us.

jog on

duc

Why?

Oil since August 1971 has been priced in USD, which were then recycled in USTs. Mr Putin has weaponised oil. Oil for Rubles or gold. This has necessitated a response from the rest of the world to sell USTs to obtain oil from OPEC. Oil of course is a currency. The most important currency.

And they are buying:

Gold with what is left over after buying oil.

Gold will become the floating neutral reserve asset of the world, replacing USD. The oil market is 15X larger than the gold market after 50yrs of being suppressed by the US and UK via COMEX and LBMA. Therefore gold will revalue 15X at current oil market capitalisation to provide that reserve asset to transact in oil.

The US are seeking to sue OPEC for reducing production:

Any doubt about the cohesion of OPEC+ was put to bed this week as the group’s summit in Vienna ended with a 2 million bpd production cut. This cut appears to have achieved exactly what the participating members wanted, namely higher oil prices. It appears that fears of a global economic slowdown have taken a back seat to oil market fundamentals and geopolitical uncertainty. Saudi Arabia, the country that will spearhead the production cuts (Russia is already producing at its decreased target), has put the Biden Administration between a rock and a hard place only several weeks before the midterm elections. Confronted with the prospect of rising gasoline prices, the White House needs to react swiftly if it does not want to be seen as weak.

White House Mulls Antitrust Case Against OPEC+. On the back of the OPEC+ 2 million bpd production cut, the Biden Administration threatened to trigger anti-trust action against the alliance, with legal committees in both chambers of Congress approving legislation that would allow the White House to do so.

ETFs such as GLD et al will settle in cash. Their prospectus(s) contractually allow this. Emulate the Central Banks: buy physical gold/silver. You will not be settled in gold by many of the ETFs. PHYS will (to date) but everything else is suspect until proven. By the time that you require proof, it may be too late.

Also, it looks very much like 'Operation Twist' (to address illiquidity in the Treasury market) may be turned back on. Watch this space. That is then a return to a secular inflation. A 1970's rerun is upon us.

jog on

duc

Hi ducati, my first post has gone missing.......so here I go again.I suppose it really depends on your timeframe, but gold is going higher. Much higher. How much higher 15X.

Why?

Oil since August 1971 has been priced in USD, which were then recycled in USTs. Mr Putin has weaponised oil. Oil for Rubles or gold. This has necessitated a response from the rest of the world to sell USTs to obtain oil from OPEC. Oil of course is a currency. The most important currency.

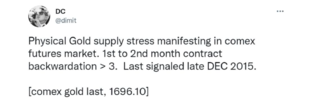

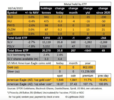

View attachment 147813

And they are buying:

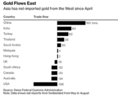

View attachment 147812

Gold with what is left over after buying oil.

Gold will become the floating neutral reserve asset of the world, replacing USD. The oil market is 15X larger than the gold market after 50yrs of being suppressed by the US and UK via COMEX and LBMA. Therefore gold will revalue 15X at current oil market capitalisation to provide that reserve asset to transact in oil.

The US are seeking to sue OPEC for reducing production:

Any doubt about the cohesion of OPEC+ was put to bed this week as the group’s summit in Vienna ended with a 2 million bpd production cut. This cut appears to have achieved exactly what the participating members wanted, namely higher oil prices. It appears that fears of a global economic slowdown have taken a back seat to oil market fundamentals and geopolitical uncertainty. Saudi Arabia, the country that will spearhead the production cuts (Russia is already producing at its decreased target), has put the Biden Administration between a rock and a hard place only several weeks before the midterm elections. Confronted with the prospect of rising gasoline prices, the White House needs to react swiftly if it does not want to be seen as weak.

White House Mulls Antitrust Case Against OPEC+. On the back of the OPEC+ 2 million bpd production cut, the Biden Administration threatened to trigger anti-trust action against the alliance, with legal committees in both chambers of Congress approving legislation that would allow the White House to do so.

ETFs such as GLD et al will settle in cash. Their prospectus(s) contractually allow this. Emulate the Central Banks: buy physical gold/silver. You will not be settled in gold by many of the ETFs. PHYS will (to date) but everything else is suspect until proven. By the time that you require proof, it may be too late.

Also, it looks very much like 'Operation Twist' (to address illiquidity in the Treasury market) may be turned back on. Watch this space. That is then a return to a secular inflation. A 1970's rerun is upon us.

jog on

duc

Thank you for your post.

Agree, gold is a limited resource which is expensive to mine and process.

I have a lot of missing links and dots, so unable to form a proper picture. I thought with the Bretton Woods System abolished by Nixon, the greenback is now the reserve currency. From what I understand, gold will never replace the greenback unless another President say so? That is not to say gold doesn't have value, indeed, it has............but with no yield, will not corrode etc......so I see it's not as valuable as it once was....but good for trading if I can get it right.

Gold was down last night with our dollar taking a beating. Talks of more aggressive rate hikes...but let's not worry about that. Have a great weekend, ducati.

- Joined

- 28 May 2020

- Posts

- 6,702

- Reactions

- 12,870

Perhaps a digital currency awaits the demise of the USD.Hi ducati, my first post has gone missing.......so here I go again.

Thank you for your post.

Agree, gold is a limited resource which is expensive to mine and process.

I have a lot of missing links and dots, so unable to form a proper picture. I thought with the Bretton Woods System abolished by Nixon, the greenback is now the reserve currency. From what I understand, gold will never replace the greenback unless another President say so?

Of note is that when Nixon killed off Bretton Woods, an ounce of gold was worth $35.

that same ounce of gold today is worth 1700.

That is why investors like gold.

Mick

In reality, digital currency has been in existence for a long time. We transfer money in digital form and have a choice to have physical money too if we withdraw small amounts from the banks.Perhaps a digital currency awaits the demise of the USD.

Of note is that when Nixon killed off Bretton Woods, an ounce of gold was worth $35.

that same ounce of gold today is worth 1700.

That is why investors like gold.

Mick

If US adopts digital currency, it will be in their greenback, so should work the same as what it is now. Don't know how it can happen solely going digital............the seniors of today will have a fit.

Perhaps Nixon thought that gold as a universal currency was a threat to the greenback? Not substantiated fact, only my thoughts, Mick. And gold went up slowly with time because it's a precious metal and cannot be printed?

- Joined

- 13 February 2006

- Posts

- 5,261

- Reactions

- 12,111

Hi ducati, my first post has gone missing.......so here I go again.

Thank you for your post.

Agree, gold is a limited resource which is expensive to mine and process.

I have a lot of missing links and dots, so unable to form a proper picture. I thought with the Bretton Woods System abolished by Nixon, the greenback is now the reserve currency. From what I understand, gold will never replace the greenback unless another President say so? That is not to say gold doesn't have value, indeed, it has............but with no yield, will not corrode etc......so I see it's not as valuable as it once was....but good for trading if I can get it right.

Gold was down last night with our dollar taking a beating. Talks of more aggressive rate hikes...but let's not worry about that. Have a great weekend, ducati.

Gold as we speak, is replacing the UST system. Both Russia and China, followed by a host of other nations (OPEC as a block, India, South Africa, Africa widely, Brazil) are all de-dollarising. The dollar as the transactional reserve currency is now over. Today. Finished. Russia and China have played a masterful strategic game, helped by inept fools in the West.

Gold as the new reserve transactional currency, will, to allow trading in energy, have to revalue. As stated, the energy markets capitalisation is 15X that of gold.

Gold will float against currencies. It will not be fixed. Some currencies, due to their levels of debt, may need to revalue their currencies as against gold if/when their currencies collapse. These valuations may well be higher than 15X.

For the US, in the short term, it will involve significant pain (UK included). Over time, it will drive the US to re-industrialise and become a manufacturing base once again. Probably a good thing.

The Fed, I think will pause with FFR hikes in November. Rather than a pivot (too embarrassing) we will see a new 'Twist' programme, which is actually a quiet QE. Rather than the Fed expanding their Balance sheet, the big Commercial banks will expand theirs as SLE (supplementary leverage ratio) ratios are reset by the Fed for the Commercials. This is functionally exactly the same as QE, just with less fanfare.

jog on

duc

I don't know about that, ducati (first paragraph)

I hope they pause for a while (hiking rates) Makes it harder for businesses and home owners if rates keep going up.

I can't think tonight, falling asleep at the keyboard.........goodnight, ducati, everyone

I hope they pause for a while (hiking rates) Makes it harder for businesses and home owners if rates keep going up.

I can't think tonight, falling asleep at the keyboard.........goodnight, ducati, everyone

Knobby22

Mmmmmm 2nd breakfast

- Joined

- 13 October 2004

- Posts

- 9,876

- Reactions

- 6,895

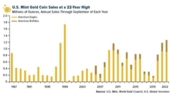

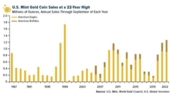

Gold Price vs Stock Market - 100 Year Chart

This chart compares the historical percentage return for the Dow Jones Industrial Average against the return for gold prices over the last 100 years.

1979 was a big year for gold.

- Joined

- 25 July 2021

- Posts

- 875

- Reactions

- 2,215

GLD is still in a downtrend;

The US Dollar is still in an uptrend but it has lost momentum as it hit the level of the recent high, the trend is extended at this point so there is a chance of a consolidation or reversal here;

The $AUD-USD also shows some loss of momentum in an extended trend;

If GLD does keep falling from here it could get down to the 147-143 area;

The US Dollar is still in an uptrend but it has lost momentum as it hit the level of the recent high, the trend is extended at this point so there is a chance of a consolidation or reversal here;

The $AUD-USD also shows some loss of momentum in an extended trend;

If GLD does keep falling from here it could get down to the 147-143 area;

- Joined

- 13 February 2006

- Posts

- 5,261

- Reactions

- 12,111

The charts represent 'paper gold' and as such are worthless. Less than worthless because essentially they are propaganda.

The debt is eating the US alive. This does not even show the level of off-balance sheet Eurodollar loans made to systemically important European Banks. Credit Suisse this week was the recipient of a $10B swap arrangement (bailout) from the Fed. Why? CS has $8.8 Trillion in Swaps that as the UK implodes are slowly sinking underwater. The $10B represents payments that need to be made on those Swaps that CS does not have.

Will this be enough?

Not even close.

Soon there will be capital controls in the West.

The sad reality is that the West is being annihilated.

You want bullion. With legal title.

The Miners are likely not going to participate, nor offer the value as they did in the 1970's. Lots of reasons why. Possibly Royalty stocks could be a better way to play the miners. MTA is one such (I hold MTA shares) that could be considered.

jog on

duc

The debt is eating the US alive. This does not even show the level of off-balance sheet Eurodollar loans made to systemically important European Banks. Credit Suisse this week was the recipient of a $10B swap arrangement (bailout) from the Fed. Why? CS has $8.8 Trillion in Swaps that as the UK implodes are slowly sinking underwater. The $10B represents payments that need to be made on those Swaps that CS does not have.

Will this be enough?

Not even close.

Soon there will be capital controls in the West.

The sad reality is that the West is being annihilated.

You want bullion. With legal title.

The Miners are likely not going to participate, nor offer the value as they did in the 1970's. Lots of reasons why. Possibly Royalty stocks could be a better way to play the miners. MTA is one such (I hold MTA shares) that could be considered.

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,261

- Reactions

- 12,111

Knobby22

Mmmmmm 2nd breakfast

- Joined

- 13 October 2004

- Posts

- 9,876

- Reactions

- 6,895

Backwardation.

Good word for losing value.

Better hope China and India don't lose interest in it.

Silver is probably a better bet as we need it.

www.silverinstitute.org

www.silverinstitute.org

Good word for losing value.

Better hope China and India don't lose interest in it.

Silver is probably a better bet as we need it.

SILVER IN INDUSTRY |

Last edited:

Knobby22

Mmmmmm 2nd breakfast

- Joined

- 13 October 2004

- Posts

- 9,876

- Reactions

- 6,895

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Can't really believe we are in the 2615-2665 range so quickly...returning to the scenes of the crimes

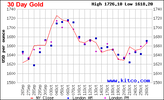

View attachment 147654

Very fast move on the way up through the 2615-2665 region, price ran to 2677 to trigger stops and then retraced as supply quickly returned at those levels.

I was bleary eyed watching the hours before the NYSE open on Friday night to see a hefty rejection at the bottom of that range, 2614 or so.

Despite the rise in price, not too sure how bullish it is honestly. Seems to me more like we ran out of supply and floated up to where more could be found, and it was. Could easily tumble back down to 2560 the previous resistance now.

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,769

- Reactions

- 10,527

It was the best of times and the worst of times. A fair bit of weather especially just north of the Sunshine Coast.

I have just returned from inspecting my buried gold, a journey that took me all the way down to Uki in the Northern Rivers of NSW ( that whole area should have a special addendum to the Constitution to state it is really in Queensland ) back up home again to a couple of dozen ounces buried within 50 km of Charters Towers, appropriately.

Much rain but no hailstones to damage a fully refurbished Arnage, thanks Rick, in Tweed West.

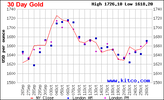

Gold has made a good recovery since my sojourn in NSW and Southwest and Western Queensland in $USD, a simple chart should suffice.

More significantly in $AUD it is good as the Aussie meets some headwinds although there are signs of a recovery. At this moment Gold is $USD 1664.20 and $AUD 2566.95.

It could go either way.

gg

I have just returned from inspecting my buried gold, a journey that took me all the way down to Uki in the Northern Rivers of NSW ( that whole area should have a special addendum to the Constitution to state it is really in Queensland ) back up home again to a couple of dozen ounces buried within 50 km of Charters Towers, appropriately.

Much rain but no hailstones to damage a fully refurbished Arnage, thanks Rick, in Tweed West.

Gold has made a good recovery since my sojourn in NSW and Southwest and Western Queensland in $USD, a simple chart should suffice.

More significantly in $AUD it is good as the Aussie meets some headwinds although there are signs of a recovery. At this moment Gold is $USD 1664.20 and $AUD 2566.95.

It could go either way.

gg

Similar threads

- Replies

- 1

- Views

- 519

- Replies

- 171

- Views

- 10K

- Replies

- 7

- Views

- 2K