Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,487

- Reactions

- 22,487

On Wall St at Friday, 4pm: Dow -2.8%, S&P 500 -3.9%, Nasdaq -4.7%

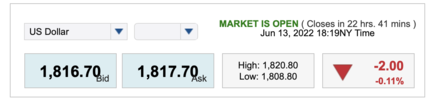

Spot gold -2.3% to $US1828.45 an ounce

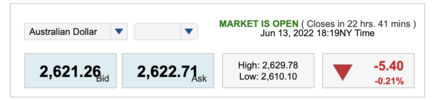

not much safety here though AUD -1.9% to 69.24 US cents, as well.

Spot gold -2.3% to $US1828.45 an ounce

not much safety here though AUD -1.9% to 69.24 US cents, as well.