- Joined

- 29 January 2006

- Posts

- 7,219

- Reactions

- 4,446

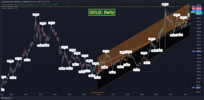

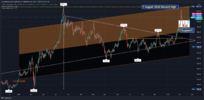

Below is the linear regression trend from 2020, which is nicely positive:

Prior to last Friday, POG was stuck in a holding pattern for a month, and today - Easter Monday - shows an initial breakout.

As all we armchair quarterbacks (to borrow that American phrase) have prognosticated, a push into new record highs in coming months is decidedly likely.

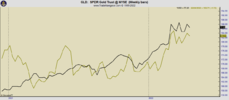

More interesting is the long term regression, below, from December 2015's low:

Prior to last Friday, POG was stuck in a holding pattern for a month, and today - Easter Monday - shows an initial breakout.

As all we armchair quarterbacks (to borrow that American phrase) have prognosticated, a push into new record highs in coming months is decidedly likely.

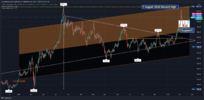

More interesting is the long term regression, below, from December 2015's low: