Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,893

- Reactions

- 10,794

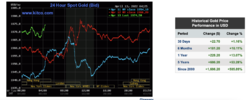

Gold remains rangebound.

It would not surprise me to see a whiplash either way, down towards $USD 1800 or up to $USD 2100.

These are nice spots to be contrarian and take small profits or buy long from the convicted. I say that not in relation to Eddie, Moses and Ian at Cooma who I am told by the Prison Visitors Committee here at the hotel are ASF members but people with fixed ideas on the direction of Gold.

Long term, which these days is 2 weeks + , Gold is on the up.

gg

It would not surprise me to see a whiplash either way, down towards $USD 1800 or up to $USD 2100.

These are nice spots to be contrarian and take small profits or buy long from the convicted. I say that not in relation to Eddie, Moses and Ian at Cooma who I am told by the Prison Visitors Committee here at the hotel are ASF members but people with fixed ideas on the direction of Gold.

Long term, which these days is 2 weeks + , Gold is on the up.

gg