Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,480

- Reactions

- 11,927

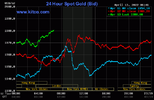

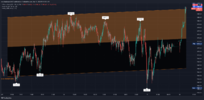

Quite and interesting 3 days on Gold and some stats on it's progress since 200o.

From Kitco.com

View attachment 140392

gg

Breaking through the 1960 level makes me think the bias is short term up, but with so much volatility due to the geopolitics it's anyone's guess.