- Joined

- 24 December 2005

- Posts

- 2,601

- Reactions

- 2,065

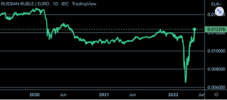

I am still playing with the concept of volume spikes as an indicator for future price movements. If I see a large volume spike at a high point I am thinking a decent fall and vice versa if a spike is at the bottom of a price fall then I would expect a rising price.

Having said that I am wondering if we will see a fall in the POG, I am not too sure about this one because it is not at either a major top to cause a fall nor is it at a major bottom for a rise. It is a very big volume spike. Interested to watch, I am thinking fall but may not be, just me amusing myself with charts folks.

Having said that I am wondering if we will see a fall in the POG, I am not too sure about this one because it is not at either a major top to cause a fall nor is it at a major bottom for a rise. It is a very big volume spike. Interested to watch, I am thinking fall but may not be, just me amusing myself with charts folks.