- Joined

- 20 December 2021

- Posts

- 218

- Reactions

- 500

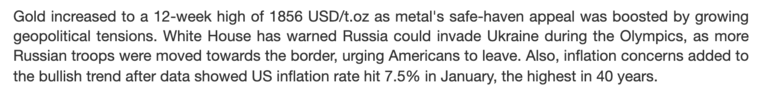

Gold prices could actually be in for a week of added volatility with the US CPI figures out on Thursday.

The precious metal extended its break back above the 200-day MA on Monday, supported by a weaker US Dollar, and inflows into gold ETFs as a hedge against inflation and volatility in equities. But with the forecast for inflation to hit a 40-year high, it should be interesting to see whether gold prices continue to rally, or if this is just speculation in the build-up.

The US Dollar should already regain some ground after today’s bond market sell-off caused US 10-year yields to surge to their highest level in over 2 years. If the inflation print is strong, it will also likely add to speculation of a 50bps hike from the Fed as opposed to the original 25bps plan, which could see even more USD bulls re-enter the market.

The downward trending resistance coming from mid-2020, and the uptrend support from August 2021 are narrowing and will converge soon, so gold prices are likely on the cusp of a breakout in either direction. All trading carries risk, but will this week provide an early indication into which way the move will be?

The precious metal extended its break back above the 200-day MA on Monday, supported by a weaker US Dollar, and inflows into gold ETFs as a hedge against inflation and volatility in equities. But with the forecast for inflation to hit a 40-year high, it should be interesting to see whether gold prices continue to rally, or if this is just speculation in the build-up.

The US Dollar should already regain some ground after today’s bond market sell-off caused US 10-year yields to surge to their highest level in over 2 years. If the inflation print is strong, it will also likely add to speculation of a 50bps hike from the Fed as opposed to the original 25bps plan, which could see even more USD bulls re-enter the market.

The downward trending resistance coming from mid-2020, and the uptrend support from August 2021 are narrowing and will converge soon, so gold prices are likely on the cusp of a breakout in either direction. All trading carries risk, but will this week provide an early indication into which way the move will be?