- Joined

- 25 July 2021

- Posts

- 877

- Reactions

- 2,215

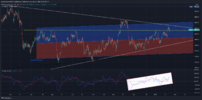

The most compelling chart for GLD right now (Market Video Update) - The Steady Trader

After a frustrating period for traders and investors in the GLD etf, the recent relative strength is showing some signs of hope. In this video I discuss the most important chart for the GLD etf right now