- Joined

- 13 February 2006

- Posts

- 5,332

- Reactions

- 12,329

So one of the issues in the gold and silver markets, particularly now, or rather specifically now post Basel III is the split between the physical OTC market and the COMEX futures market. The OTC market is opaque and difficult to get a read on. It is however crucial because the historical tamping down of the gold and silver prices was essentially an arbitrage for the Bullion banks (BB) using paper gold: ie. they did not need to hold physical gold for delivery. Now they do or pay margin for the paper, which makes the whole exercise rather pointless.

The BB are still active in the OTC market, but nowhere as near active as they need to hold physical deliverable to hold a hedged position if short on the COMEX. This is the reason for the halving of OI.

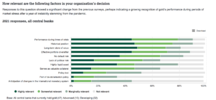

Central Banks have been consistent buyers in the market:

In chart 1, look at the last reason provided for purchase. This is being driven by China & Russia. China in particular have under-reported their physical holdings for decades.

Looking at production data:

China does not export gold. It does however import gold. Estimates of PBOC holdings range up to 20,000 tonnes.

The selling pressure in Gold (and Silver) has evaporated.

If you track the data, which I do in silver (but not in gold) you can see that the selling pressure is as about as low as it gets. Essentially the games boil down to bid pulling and some spoofing at EMAs etc.

The continuation in the bull market in gold/silver is probably just round the corner in Q2.

jog on

duc

The BB are still active in the OTC market, but nowhere as near active as they need to hold physical deliverable to hold a hedged position if short on the COMEX. This is the reason for the halving of OI.

Central Banks have been consistent buyers in the market:

In chart 1, look at the last reason provided for purchase. This is being driven by China & Russia. China in particular have under-reported their physical holdings for decades.

Looking at production data:

China does not export gold. It does however import gold. Estimates of PBOC holdings range up to 20,000 tonnes.

The selling pressure in Gold (and Silver) has evaporated.

If you track the data, which I do in silver (but not in gold) you can see that the selling pressure is as about as low as it gets. Essentially the games boil down to bid pulling and some spoofing at EMAs etc.

The continuation in the bull market in gold/silver is probably just round the corner in Q2.

jog on

duc