- Joined

- 28 May 2020

- Posts

- 6,826

- Reactions

- 13,131

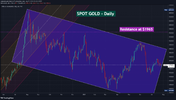

Because of the steep recent fall in the AUD, Goldi n AUD is now approaching the 2500 mark.

For those unhedged miners, these are good returns times.

I am a bit surprised that there has not been a bit of as surge in some of the goldies, but more than happy to wait.

Mick

For those unhedged miners, these are good returns times.

I am a bit surprised that there has not been a bit of as surge in some of the goldies, but more than happy to wait.

Mick