explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

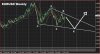

Nice charting Sinner, thanks.

The post from InTheMoneyStocks on the 'Commodity Stocks Get Rocked' thread is interesting, explaining the negative effects on increasing interest rates in Asia. Thread at: https://www.aussiestockforums.com/forums/showthread.php?t=21690

Thanks Sinner and Logique for the interesting insights therein.

On the commodity pressure scenario I see gold and silver as more and more in the currency sector. I think that the general finance community believe that inflation will pop the p/m's. It is my take that debt has become an impossible problem, not just in the US but many western countries. A rise in interest rates in these nations will pop the cork and debt defaults will become the overiding factor.

Gold will then become the safe haven and not the US dollar as is now still the case in many minds.

Very interesting times