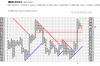

My target has long been $1300 in round numbers, actually around the 1296 area but perhaps that is getting a little precise. It is around 50% Fibo retracetment level on the recent rally, closing in on the 200 DMA and if we bounce out of it looks like it will keep the weekly trendline intact. Failing that I think that we are looking at the 1260 area, near logical support and the 23.6% retracetment level of the entire 2008 to date rally. I would be surprised to see it much lower and I think there is a slim chance in may hold here. I'm not big on that option, I think that there is a week or twos more work to do.