You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

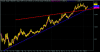

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

- Joined

- 12 January 2011

- Posts

- 58

- Reactions

- 0

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

An intersting article on the distinctions between investment and or trading gold as apposed to the growing trend of hoarding gold.

The argument raised is that perhaps normal technical chart anaylsis does not present the overall picture.

http://www.financeandeconomics.org/Articles archive/2011.02.08 Metals_technical.htm

The argument raised is that perhaps normal technical chart anaylsis does not present the overall picture.

http://www.financeandeconomics.org/Articles archive/2011.02.08 Metals_technical.htm

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

Silver, having jumped US$4 an ounce in the last few weeks is close again to its 30 year high at US$30.80

This move by silver on a Monday is also very bullish in my view.

When/if silver closes and consolidates above this level the gold price should make another run and cross its all time high of US$1423.70

This is pure speculation based upon my own observations.

Looking forward to Electronicmaster's insert to the silver thread.

This move by silver on a Monday is also very bullish in my view.

When/if silver closes and consolidates above this level the gold price should make another run and cross its all time high of US$1423.70

This is pure speculation based upon my own observations.

Looking forward to Electronicmaster's insert to the silver thread.

tinhat

Pocket Calculator Operator

- Joined

- 1 May 2009

- Posts

- 1,756

- Reactions

- 769

I'd just wish my gold stock(KCN) would rise with the gold price.

I took a look at KCN recently because on first glance, it's falling share price seems looks to be good value. I'm a bit worried however at their recent acquisitions of Laguna Resources and Dominion Mining. The price seems to have bottomed at the moment. Do you have any view about whether these acquisitions are going to add to or be a drain on the bottom line in the short term?

I did buy some MML recently and will be looking to top up that holding when opportunities arise to do so.

My position on gold is long term bullish but I am sure there will be volatility in the short and medium term.

I took a look at KCN recently because on first glance, it's falling share price seems looks to be good value. I'm a bit worried however at their recent acquisitions of Laguna Resources and Dominion Mining. The price seems to have bottomed at the moment. Do you have any view about whether these acquisitions are going to add to or be a drain on the bottom line in the short term?

I can only see it as a good thing in the long run. Dominion Mining is producing and making a profit, not sure why KCN bought Laguna Resources.

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

- Joined

- 12 January 2011

- Posts

- 58

- Reactions

- 0

- Joined

- 12 February 2011

- Posts

- 34

- Reactions

- 0

Very interesting charts last night.

Massive move in silver not so much with gold.

the AUD moved a fair bit too which decreased the % increase for gold and silver.

Interesting to see what happens tonight O/S

Massive move in silver not so much with gold.

the AUD moved a fair bit too which decreased the % increase for gold and silver.

Interesting to see what happens tonight O/S

- Joined

- 12 February 2011

- Posts

- 34

- Reactions

- 0

I think Gold prices will be in for a bullish year.

$1400-$1500 p/oz.

Agreed and silver will hit $50 this year. (my belief) then retract and settle about 45ish.

Worthwhile checking out the silver chart right now!

Silver up 3%!

Great moves in gold, silver and their respective primary producers since my last post.

Managed to grab a couple of daily calls last week 31.20 and 32.60, which provided great returns for the day they were tracking (Thursday and Friday of last week respectively). The 32.60 call was awesome, but I ended up getting out at way less than the maximal profit offered because of that takedown into the COMEX close Fri night. Earlier took that paper gold long mentioned here so currently loving this bull.

because of that takedown into the COMEX close Fri night. Earlier took that paper gold long mentioned here so currently loving this bull.

No charts from me right now, the old ones still contain the info required. Gold:Oil and Dow:Gold seem to be the ratios to watch for clues.

Managed to grab a couple of daily calls last week 31.20 and 32.60, which provided great returns for the day they were tracking (Thursday and Friday of last week respectively). The 32.60 call was awesome, but I ended up getting out at way less than the maximal profit offered

No charts from me right now, the old ones still contain the info required. Gold:Oil and Dow:Gold seem to be the ratios to watch for clues.

I'm looking for a confirming higher low here... 50DMA is best case. 200DMA not off the table until that has been put in place. Nice strength in silver, golds limited confirmation will have the market worried. I think we are close to done here but not out of the woods... a week or two max ---> I hope

:

:

- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

Did you read the piece on RNG explod?

That read like a ramp and yet Michael Pascoe gave gold a pasting in his piece.

Only time will tell. Haven't heard anything to change the fact that gold is in diminishing supply. Haven't heard anything either about people spending less on daily consumables or decreases in Un or Underemployment in developed G8 economies

What's next for the deflationists? I suppose it will be to argue that Engel's Coefficient doesn't really exist and now that developing nations have more purchasing power and production they will buy less commodities due to rising incomes and prosperity. Who needs a healthy diet when you're a rapidly growing developing country opening up to the free market for the first time and have infrastructure pipeline projects to build for the next couple of decades? It does require an abstract view of things and the future to really get why gold is now trading with 3 zero's. Oh and not to mention, that a portion of that new found wealth in these places will not consider gold as an investment India No.1 and China No.2.

So as a result a bear market in commodities will trounce gold! As if...IMHO

Happy days!

I love the gold thread. or as Peter Schiff would say "look in the rear-view mirror". There is no inflation.

As the mob would say ""Forget about it""

Sept 4, 2009

[video]http://news.goldseek.com/EuroCapital/1252074153.php[/video]

- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

Revisiting the thread this is great to explain whats going on. Whether you agree with the presenter/mechanics analysis is up to you?

http://news.bbc.co.uk/2/hi/business/7924506.stm

http://news.bbc.co.uk/2/hi/business/7924506.stm

- Joined

- 12 February 2011

- Posts

- 34

- Reactions

- 0

Revisiting the thread this is great to explain whats going on. Whether you agree with the presenter/mechanics analysis is up to you?

http://news.bbc.co.uk/2/hi/business/7924506.stm

I love it how Zimb was ridiculed for printing money and when the western governments do it no one knows/understands it.

Granted Zimbabwe was doing it on a larger scale and had some more underlining problems.

But still...

The conversation at the water cooler with one guy was

"the bloody Zimbabweans printing money like no tomorrow"

i replied, "so are we"

"yeh but were different.." and on he went talking when he should have kept his mouth shut, clearly had no idea, just our typical mentality "were Australians, were different, our housing markets different no crash....."

Since when is Australia printing money like no tomorrow?I love it how Zimb was ridiculed for printing money and when the western governments do it no one knows/understands it.

Granted Zimbabwe was doing it on a larger scale and had some more underlining problems.

But still...

The conversation at the water cooler with one guy was

"the bloody Zimbabweans printing money like no tomorrow"

i replied, "so are we"

"yeh but were different.." and on he went talking when he should have kept his mouth shut, clearly had no idea, just our typical mentality "were Australians, were different, our housing markets different no crash....."

- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

Since when is Australia printing money like no tomorrow?

It's not tothemax6.

It's borrowing it like there is no tomorrow!

Similar threads

- Replies

- 1

- Views

- 527

- Replies

- 171

- Views

- 10K

- Replies

- 7

- Views

- 2K