- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

The prevailing wisdom is that value gaps (FVGs) will tend to draw the price towards them for rebalancing. That's definitely true in regards to longer TFs.

For smaller TFs, I'm more inclined to view a dense collection of FVGs as being supportive of the trend. And vice versa, meaning that a few thin gaps above the current price are more likely to be rebalanced before a thick collection of them below the price (if long, that is).

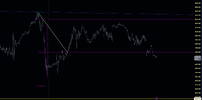

eg. in this chart, so long as there's other reasons supporting a long position, the single FVG above the price is more likely to be rebalanced before the large clump below the price.

For smaller TFs, I'm more inclined to view a dense collection of FVGs as being supportive of the trend. And vice versa, meaning that a few thin gaps above the current price are more likely to be rebalanced before a thick collection of them below the price (if long, that is).

eg. in this chart, so long as there's other reasons supporting a long position, the single FVG above the price is more likely to be rebalanced before the large clump below the price.