- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

eeek.

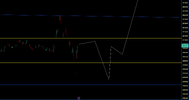

Still holding. So the plan was that if 4155 or 4160 don't hold, I'll sell. Will still be in profit.

Still holding. So the plan was that if 4155 or 4160 don't hold, I'll sell. Will still be in profit.