- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Skate's "Simple Strategy"

This exercise was to develop a strategy, but not any strategy but a strategy that is built on the entire premise of buying into the strength of a confirmed trend. The name of the strategy is unremarkable but at least it fully explains what the strategy is all about, "Simplicity". I'm over reading all the gurus telling me "ways to trade" but over the years I've found keeping a trading strategy simple is the way to go. I wanted to code the simplest strategy I could using only a few moving parts. The strategy uses the (ADX & ROC) buying into strength.

The "Simple Strategy" - "simply" buys into strength

When it comes to evaluating the "strength of a trend" the average directional index (ADX) is good as any to determine it. It's a simple idea of making sure that the (ADX) is greater than the previous 3 consecutive periods. The "Volume" over an "nPeriod" needs to be increasing as well. A stand-alone (ROC) filter is a primary guide kicking the (ADX) into gear. The PositionScore is entirely dependent on the ROC.

New ideas

The exercise was to throw a new trading idea out there so I could make a series of posts but to my surprise this simple idea isn't too shabby at all. So "what the heck" I'll live trade it instead.

Instead of posting

I greedily started to trade the "Simple Strategy" with the other 4 strategies. Trading the Simple strategy came after I had made the equity Chart for the combined 4 strategies so I placed it on its own worksheet.

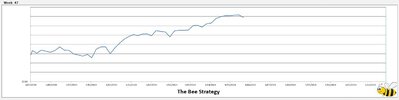

Trading the Simple Strategy is motoring along

It's early days but I can't wait till the strategy is full. Being very selective with what it buys it will take a few weeks to fill the strategy. (Only 9 positions in the portfolio so far)

Keeping it simple

No more than a few indicators & a handful of filters & "Bob's your uncle" a simple strategy to add to my trading stable.

Skate.