You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dump it Here

- Thread starter Skate

- Start date

- Joined

- 8 June 2008

- Posts

- 13,306

- Reactions

- 19,674

I am all good with "Skate's flying bat" strategy nameView attachment 124680

It's plagiarising

I know @qldfrog reads my thread so it's unlikely that I can get away with renaming my "Bee Strategy". Damn you frog for taking all the good names!!!!

Skate.

The only worry is that we will have an urge to compate and that will not be flattering for me

Had some time to think about your words of wisdom, and i should listen to them.i should continue my testing refining my parameters and restraining jumping in.

For the new comers, in feb 2019, i paper traded for a month, procrastinating and lost a sizeable amount of profit, nice paper virtual profit :-(

, more than this whole year seems to be heading for.. .

So kind of trying to avoid repeat but i also rushed too early later on with a code bug..and substantial loss before exiting.

Lets try to give the frog flying bat a rest for a fortnight and listen to wisdom

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

How can I reduce the number of opportunities to a manageable level?

(i) Prioritise the stocks with the lowest price (like @Skate)

(ii) Prioritise the positions that use the lowest amount of capital ==> more trades

(iii) Historical volatility, trade stocks that really move

(iv) Prioritise the setups with the lowest volatility compared to historical volatility

(v) Prioritise those showing more relative strength to the index (RSC (XAO)). - weekly time frame.

Other than prioritise the winning opps, any other ideas?

Trading questions

When someone knows that you trade it raises some silly questions, questions from not understanding. Imagine knowing a person is a doctor & ask "what pill should I take as I don't feel well"? - What about asking a car salesman "what's the best car to buy" or a real estate agent "how much does a home cost"? - I'm sure everyone has a relatable story.

It's not that simple

Trading is more complex than I believe it should be. It's complex because of so many variables that can't be captured because of the fluidity of the markets that are driven in one direction or the other. At other times positions are simply manipulated.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Negativity leads to negative thinking

Without a doubt, having a positive outlook is important. To that end, believing that your trading strategy will be profitable is certainly valuable. However, mismanagement of your trading is another thing. Trading by its very nature is risky, but there are ways to manage & minimise the risks.

Overstaying your welcome

Staying too long in a trade is a recipe for disaster. As traders, we must focus most of our time & attention on the mental side of trading. If you get that right, everything falls into place for you. The good news is, profitable trading is simpler than you might think but far from easy. When the markets are having a down day there are those who want to fix something that not broken. Trading has a natural ebb & flow that affects everyone emotionally when they persist.

Skate.

Without a doubt, having a positive outlook is important. To that end, believing that your trading strategy will be profitable is certainly valuable. However, mismanagement of your trading is another thing. Trading by its very nature is risky, but there are ways to manage & minimise the risks.

Overstaying your welcome

Staying too long in a trade is a recipe for disaster. As traders, we must focus most of our time & attention on the mental side of trading. If you get that right, everything falls into place for you. The good news is, profitable trading is simpler than you might think but far from easy. When the markets are having a down day there are those who want to fix something that not broken. Trading has a natural ebb & flow that affects everyone emotionally when they persist.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Trading ideas

Some of the best ideas are simple to construct & simple to execute. There are those who want to squeeze every dollar out of the markets & this is when trading gets complicated. There will never be a time when you can make a splash in the markets as that's the "big boy's domain" but what you can do is place yourself in such a position to be splashed. Catching those splashes is what makes you the money.

Catching splashes

The "Dump it here" thread is chock full of trading ideas that allow you to catch some splashes. The first goal when starting out is to be "profitable" & this can be achieved with a bit of hard work & education. Being "consistently profitable" lifts you to a whole new level.

In the next few posts

I'll recap some of those trading ideas. If you relate to any of them "do a search" to understand them a little bit better.

Skate.

Some of the best ideas are simple to construct & simple to execute. There are those who want to squeeze every dollar out of the markets & this is when trading gets complicated. There will never be a time when you can make a splash in the markets as that's the "big boy's domain" but what you can do is place yourself in such a position to be splashed. Catching those splashes is what makes you the money.

Catching splashes

The "Dump it here" thread is chock full of trading ideas that allow you to catch some splashes. The first goal when starting out is to be "profitable" & this can be achieved with a bit of hard work & education. Being "consistently profitable" lifts you to a whole new level.

In the next few posts

I'll recap some of those trading ideas. If you relate to any of them "do a search" to understand them a little bit better.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Trading ideas - The "HappyCat Strategy"

# The "HappyCat Strategy" is one of my simple trading ideas that uses volatility & momentum to enter & exit positions. By using just two indicators (ROC & ATR) is what keeps this strategy simple. Typically, the “HappyCat Strategy” analyses momentum & volatility near the top & bottom of a price range helping to identify where to enter & exit a trade. The two indicators (ROC & ATR) focus on the volatility & momentum during price consolidation & retracements in an uptrend. Unfortunately, the "HappyCat" will struggle if the markets decide to trend lower after the position is taken.

Skate.

# The "HappyCat Strategy" is one of my simple trading ideas that uses volatility & momentum to enter & exit positions. By using just two indicators (ROC & ATR) is what keeps this strategy simple. Typically, the “HappyCat Strategy” analyses momentum & volatility near the top & bottom of a price range helping to identify where to enter & exit a trade. The two indicators (ROC & ATR) focus on the volatility & momentum during price consolidation & retracements in an uptrend. Unfortunately, the "HappyCat" will struggle if the markets decide to trend lower after the position is taken.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Trading ideas - The "High5 Strategy"

# The High5 Strategy is another simple strategy that enters on the higher high of the previous 5 periods & exits when there have been 5 lower highs since the entry. The strategy is so simple it’s hard to believe something so simple could have legs.

Skate.

# The High5 Strategy is another simple strategy that enters on the higher high of the previous 5 periods & exits when there have been 5 lower highs since the entry. The strategy is so simple it’s hard to believe something so simple could have legs.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Trading ideas - The "MAP Strategy"

# The "MAP Strategy" is another simple plain envelope trading strategy that is worthy to understand. The MAP strategy has two different buy conditions for entry. The first ‘Buys Signal’ is when the closing price is above a moving average period & the second signal is where there is a 10% increase in the closing price compared to the previous week's close.

Skate.

# The "MAP Strategy" is another simple plain envelope trading strategy that is worthy to understand. The MAP strategy has two different buy conditions for entry. The first ‘Buys Signal’ is when the closing price is above a moving average period & the second signal is where there is a 10% increase in the closing price compared to the previous week's close.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Trading ideas - The "CAM Strategy"

# The CAM strategy is a little more complex as it buys pullbacks in existing trends and buys countertrends when the rally continues. To better explain the CAM - pullback (CAM-PB), is when both the 10-period (ADX) and (MACD) are declining but the 14-period (CCI) is above zero. The CAM countertrend (CAM-CT), is when the 10-period (ADX) is declining but (MACD) is rising] and today’s close crosses above the 13-period EMA. Using a combination of entries catches more than just one.

Skate.

# The CAM strategy is a little more complex as it buys pullbacks in existing trends and buys countertrends when the rally continues. To better explain the CAM - pullback (CAM-PB), is when both the 10-period (ADX) and (MACD) are declining but the 14-period (CCI) is above zero. The CAM countertrend (CAM-CT), is when the 10-period (ADX) is declining but (MACD) is rising] and today’s close crosses above the 13-period EMA. Using a combination of entries catches more than just one.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Trading ideas - "The Box Strategy"

# The Box Strategy is a trend continuation strategy & buys after a new high is reached after a pullback within the trend & sells the position when the Rate of Change filter (ROC) drops below zero or when the closing price is below a variable trailing stop. Buying pullback is a favourite to many traders.

Skate.

# The Box Strategy is a trend continuation strategy & buys after a new high is reached after a pullback within the trend & sells the position when the Rate of Change filter (ROC) drops below zero or when the closing price is below a variable trailing stop. Buying pullback is a favourite to many traders.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Trading ideas - The "Panda Strategy"

# The "Panda Strategy" uses an extensive amount of mathematical gymnastics to arrive at an entry point. The mathematical trick modifies a section of an EMA that automatically smooths the magnitude of price changes. In summary, it turns the EMA into an adaptive moving average that features rapid adaptation to volatility in price movement.

Skate.

# The "Panda Strategy" uses an extensive amount of mathematical gymnastics to arrive at an entry point. The mathematical trick modifies a section of an EMA that automatically smooths the magnitude of price changes. In summary, it turns the EMA into an adaptive moving average that features rapid adaptation to volatility in price movement.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Recent Trading ideas

I'm trading a combination of strategies & recently discussed five of them. The strategies are not that correlated making the best of each trading opportunity. The ideas of how to enter a position are only limited by your imagination. This thread is littered with trading ideas & admittedly some are more successful than others but that's not the point. The point is that you need to be able to have "confidence" in the system you elect to trade or it won't reach its full potential.

Skate.

I'm trading a combination of strategies & recently discussed five of them. The strategies are not that correlated making the best of each trading opportunity. The ideas of how to enter a position are only limited by your imagination. This thread is littered with trading ideas & admittedly some are more successful than others but that's not the point. The point is that you need to be able to have "confidence" in the system you elect to trade or it won't reach its full potential.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Ranking positions

PositionScore is a ranking system used by Amibroker. There are other important aspects to coding a "half-decent" strategy. @ducati916 nominated the entry as the most important. It's the reason I've concentrated on discussing this part of the strategies (entries). While @qldfrog & @peter2 as well as others are grappling with other aspects of their trading.

Let's not forgets exits

I maintain the entry is important but the money is banked when you exit a position. The "exit" simply decides the profitability of the trade. Getting out too early or a little bit too late can have severe consequences to the profitability of any strategy, that's why it's so important to get it right.

Skate.

PositionScore is a ranking system used by Amibroker. There are other important aspects to coding a "half-decent" strategy. @ducati916 nominated the entry as the most important. It's the reason I've concentrated on discussing this part of the strategies (entries). While @qldfrog & @peter2 as well as others are grappling with other aspects of their trading.

Let's not forgets exits

I maintain the entry is important but the money is banked when you exit a position. The "exit" simply decides the profitability of the trade. Getting out too early or a little bit too late can have severe consequences to the profitability of any strategy, that's why it's so important to get it right.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

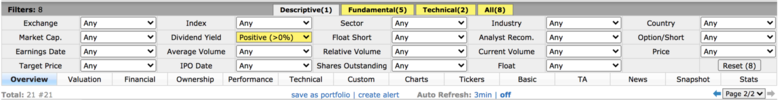

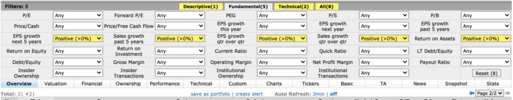

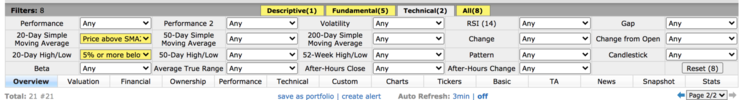

Filters are so important

I want to use a real estate agent analogy when buying a home. The first thing he will do is to ask you a series of questions (filters) to make sure he only shows you homes that meet your criteria. Trading is no different. The parameters of those filters give you the best "bang-for-buck".

There is so much more to a shirt than just the buttons

Constructing a strategy is similar to making a shirt. Buttons or no buttons, collar or no collar, short or long sleeves, what material to be used & so on. The first question should have been "why do you need the shirt"?

I've used a shirt as an example

Imagine if I had used a house or an airplane instead of a shirt, could you imagine the complexity.

Skate.

I want to use a real estate agent analogy when buying a home. The first thing he will do is to ask you a series of questions (filters) to make sure he only shows you homes that meet your criteria. Trading is no different. The parameters of those filters give you the best "bang-for-buck".

There is so much more to a shirt than just the buttons

Constructing a strategy is similar to making a shirt. Buttons or no buttons, collar or no collar, short or long sleeves, what material to be used & so on. The first question should have been "why do you need the shirt"?

I've used a shirt as an example

Imagine if I had used a house or an airplane instead of a shirt, could you imagine the complexity.

Skate.

- Joined

- 13 February 2006

- Posts

- 5,292

- Reactions

- 12,210

Trading ideas - The "CAM Strategy"

# The CAM strategy is a little more complex as it buys pullbacks in existing trends and buys countertrends when the rally continues. To better explain the CAM - pullback (CAM-PB), is when both the 10-period (ADX) and (MACD) are declining but the 14-period (CCI) is above zero. The CAM countertrend (CAM-CT), is when the 10-period (ADX) is declining but (MACD) is rising] and today’s close crosses above the 13-period EMA. Using a combination of entries catches more than just one.

Skate.

This is the one that I would seek to replicate in the following way using the finviz scan: https://finviz.com/

There is only 1 stock, WTS over the page.

You can quickly get the thumbnail of the chart by hovering over the symbol. If it is in a trend, you'll see it in 2 seconds. If you have to think about it, it's not trending.

Of the above scan I like:

HCA (Healthcare)

NWL (Personal goods)

OC (Building)

WTS (Water)

Whole exercise takes about 15 mins.

jog on

duc

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

What a great quoteGiving back profit sucks and I would not recommend it.

I have to agree with @BlindSquirrel "giving back profits - sucks"

Let's talk about up days & down days

Looking at the daily gyrations of my trading account over the month of May can be unsettling, to say the least, but volatility is a godsend for the markets.

It can be difficult to stay the course during periods of extreme volatility

I'm saying, embrace uncertainty, without uncertainty, there would be no opportunity. Control what you can control, staying the course requires discipline in "spades". Discipline requires paying attention to detail & these details can have a powerful impact on your overall trading results.

It’s not about what you "know" but "what you do" that's important

As a system trading, doing nothing is doing something, sitting on your hands & following your system is the best course of action even when it doesn't seem like it is. "What you do" is just as important as "what not to do".

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

BTC isn't an 'asset'. How is it an asset, other than as a speculative instrument?

I'm interested in BTC but unwilling to enter atm.

Is crypto a bubble?

I'm amazed at the amount of enthusiasm about cryptocurrencies. If enough believe crypto has value, I guess that's all it takes. I have trouble wrapping my head around that "the nothing" has a tradable value.

Cryptos - Hamish Douglass

# CIO Hamish Douglass at Magellan remarked that crypto is not an asset but is an illusion, imaginary & absolutely nothing. (Fair description)

Cryptos - Charlie Munger

# Berkshire Hathaway Vice Chairman Charlie Munger called bitcoin “disgusting & contrary to the interests of civilization.” that's been "invented out of thin air”.

Bitcoin is built on the enthusiasm of others

Bitcoin has no intrinsic value but the adoption & investment in bitcoin shows no signs of letting up anytime soon. Bitcoin is currently in unchartered territory taking a pause before the next big move.

European Union

The European Union has recently stepped in to capture & regulate all crypto. Most major countries have similar plans "so it appears" in one form or another. China has taken it one step further.

China Ban

China has banned crypto exchanges & initial coin offerings but has not barred individuals from holding cryptocurrencies. The institutions must not provide savings or services of cryptocurrency, nor issue financial products related to cryptocurrency.

HSBC Bank

HSBC chief Noel Quinn said that the bank has no plans of offering crypto to clients nor will it expand its businesses into bitcoin, citing the volatility & lack of transparency for its decision.

Skate.

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,834

- Reactions

- 10,664

Thanks @Skate. I should have clarified. I am interested in crypto, much as I am in Forex, Shorting and Options but have never had the balls to give it a go. I probably never will.Is crypto a bubble?

I'm amazed at the amount of enthusiasm about cryptocurrencies. If enough believe crypto has value, I guess that's all it takes. I have trouble wrapping my head around that "the nothing" has a tradable value.

Cryptos - Hamish Douglass

# CIO Hamish Douglass at Magellan remarked that crypto is not an asset but is an illusion, imaginary & absolutely nothing. (Fair description)

Cryptos - Charlie Munger

# Berkshire Hathaway Vice Chairman Charlie Munger called bitcoin “disgusting & contrary to the interests of civilization.” that's been "invented out of thin air”.

Bitcoin is built on the enthusiasm of others

Bitcoin has no intrinsic value but the adoption & investment in bitcoin shows no signs of letting up anytime soon. Bitcoin is currently in unchartered territory taking a pause before the next big move.

European Union

The European Union has recently stepped in to capture & regulate all crypto. Most major countries have similar plans "so it appears" in one form or another. China has taken it one step further.

China Ban

China has banned crypto exchanges & initial coin offerings but has not barred individuals from holding cryptocurrencies. The institutions must not provide savings or services of cryptocurrency, nor issue financial products related to cryptocurrency.

HSBC Bank

HSBC chief Noel Quinn said that the bank has no plans of offering crypto to clients nor will it expand its businesses into bitcoin, citing the volatility & lack of transparency of cryptocurrencies for its decision.

Skate.

My gut agrees very much with you.

But, Tulips are more expensive in the UK on Mothers Day than any other day of the year.

gg

Similar threads

- Poll

- Replies

- 258

- Views

- 21K