- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

@divs4ever, the questions below might seem straightforward but can easily lead to hasty conclusions that even the best of us can fall for. This post is a bit of fun to show that not everything is as it seems, much like in trading.

Question 1: If there were 6 apples on a table and you took two away, how many would you have?

ANSWER:

Question 2: A bat and a ball cost $1.10 in total. The bat costs $1.00 more than the ball. How much does the ball cost? _____ cents

ANSWER:

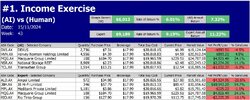

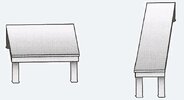

Question 3: Look at the graphic below. Which table is bigger, or are they the same size?

ANSWER:

Skate.