Richard Dale

Norgate Data

- Joined

- 22 February 2005

- Posts

- 276

- Reactions

- 206

Cheap

Good afternoon Professor and a Happy New Year to you and your trading strategies2025 - A New Journey Begins

Every day, new members join our community, seeking guidance on how to start trading. Navigating the markets can be daunting. This series of posts is designed to point you in the right direction, offering insights for beginners. Each of us has unique experiences that can inspire new ideas or help avoid common pitfalls. Sharing accumulated knowledge might just be pivotal for someone else’s success.

Here’s what you can expect

1. Start with a Plan: Define your trading goals and risk tolerance.

2. Learn the Basics: Understand market mechanics, terminology, and analysis types.

3. Practice: Use a demo account to get hands-on experience without financial risk.

4. Embrace the Learning Curve: Trading isn’t easy, but every mistake is a lesson.

Summary

Keeping it to a simple 10-step plan will give an understanding of mechanical system trading. These posts will be spread over days and weeks, continuing if there's interest. Sharing your journey helps others, and that's the ambition of this thread.

Skate.

one thing new entrants into trading ( not so important to investors )Over-posting

I fully understand that over-posting can lead to issues like information overload and possibly annoying some members, which is something we all want to avoid for a harmonious forum experience in 2025.

Hopping off the Soapbox

View attachment 190509

Skate.

Thanks @Skate. Even though I’m not a systems trader and don’t use excel I find your posts interesting, engaging and valuable. Just keep on doing what you do.Over-posting

I fully understand that over-posting can lead to issues like information overload and possibly annoying some members, which is something we all want to avoid for a harmonious forum experience in 2025.

Hopping off the Soapbox

View attachment 190509

Skate.

+ 1Thanks @Skate. Even though I’m not a systems trader and don’t use excel I find your posts interesting, engaging and valuable. Just keep on doing what you do.

gg

I have been reliably informed by my staff that a member of this site, and quite likely a participant in this thread, has been tring to take advantage of Norgate Data, by undertaking multiple "free trials" of survivorship-bias free ASX data using various identities and using various VPNs to attempt to hide his identity.

I wasn't aware that doing so under different identities or through VPNs was against your policy.

This is your first and final warning.

Thanks @Skate. Even though I’m not a systems trader and don’t use excel I find your posts interesting, engaging and valuable. Just keep on doing what you do.

gg

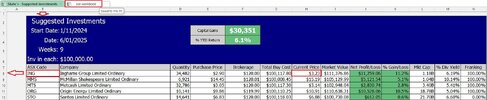

Excel's Role in Trading Basics

The possibilities are endless

When you download the "Market Index Workbook," the amount of free data available is truly mind-boggling. If you're interested, I can provide a sample spreadsheet with formulas that link to the downloaded workbook. To maintain the format, it's as simple as removing the date suffix from the workbook name:

Downloaded name

asx-workbook-20250103.xlsx

Renamed (removed the date suffix)

asx-workbook.xlsx

If you're interested

The formulas to follow. All you need is a free membership to "Market Index" and Microsoft Excel installed on your computer.

# Formulas in the next post

View attachment 190563

Skate.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.