- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Fund Manager vs. Two (AI) Models

Yesterday, we explored a one-on-one scenario between Google's Gemini (AI) and a Fund Manager. Today, we introduce Microsoft’s (AI) model, Copilot, to compare and contrast it with Google’s (AI).

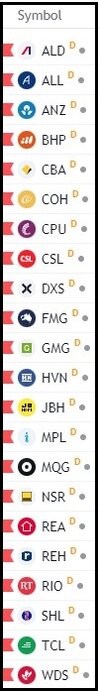

Results after 40 Weeks

While this is a fun and insightful “thought experiment,” it underscores an important point: (AI) is poised to become a crucial tool for making more informed decisions across a wide range of topics.

(AI) Model Variability

With numerous (AI) models to choose from, I’ve selected Google and Microsoft for a direct comparison. Although trained on different datasets, both models operate under the same instructions. Microsoft Copilot and Google Gemini offer unique strengths that can complement the skills of a human fund manager.

Skate.