- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

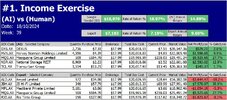

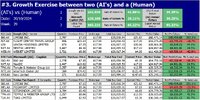

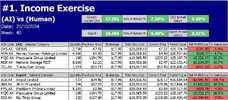

My thanks go out to @DaveTrade, @bettamania, and @dyna for showing interest in a discussion between friends on how to invest $100k over 12 months.

Trading vs. Term Deposit

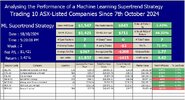

While some view trading and investing as gambling, I believe in the potential of trading a limited number of large companies. To achieve this, I have chosen to use my “WEEKLY Machine Learning SuperTrend Strategy.”

SuperTrend Overview

My weekly "Machine Learning SuperTrend Strategy" combines traditional technical analysis with machine learning techniques to create a dynamic and adaptive trading system. It utilises moving averages, dynamic zones, and adaptive volatility levels to provide buy and sell signals.

Skate.