- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

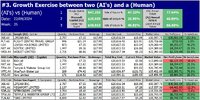

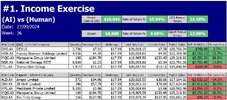

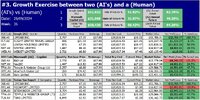

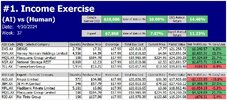

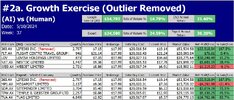

Paper Trading a Supertrend Strategy with a "Twist"

A Supertrend indicator identifies market trends using the Average True Range (ATR) to measure volatility and adjust its sensitivity. But here’s a twist to the original concept - what if we apply “Machine Learning” to enhance a basic Supertrend indicator, allowing it to adapt to different market conditions and dynamically adjust for more accurate signals?

Imagine a car GPS showing the current route

Now, think of a smart GPS that learns from past traffic patterns and adjusts your route dynamically to avoid jams — that’s what "Machine Learning" does for a Supertrend indicator.

Key Takeaways

1. A Supertrend Indicator identifies market trends.

2. A Supertrend Indicator with "Machine Learning" adapts to market conditions

3. A Supertrend Indicator with "Machine Learning" - theoretically, it should be more accurate but to no avail, with a low win rate of 38%.

4. After 12 weeks the overall results aren't too shabby.

Skate.