if I gave you a strategy would you Backtest it and do a forum post with your unbiased results

Now that would be super interesting/helpful to see!

A comparison of biased vs Richards unbiased.

Cheers

if I gave you a strategy would you Backtest it and do a forum post with your unbiased results

Actually true, same strategy, same period .Now that would be super interesting/helpful to see!

A comparison of biased vs Richards unbiased.

Cheers

Skate, I respectfully decline your request.

Systematic trading invlves a lot more skill development and knowledge acquisition. I don't think you're quite getting what systematic trading is at all. I actually might have programmed up your system earlier in this horribly long thread but your inability to acknowledge massive failings in your so-called systematic trading has worn my patience too thin. Maybe once you've done that a few hundred times with different ideas, you might start gleaning insight into some aspects of systematic trading, You'll definitely need to learn some level of statistics (or, at least, statistical concepts). This will takes a minimum of a few years of effort and experience - likely more. So, with that, I leave you to actually learn systematic trading, rather than talking about what it might be with no real basis for those statements.

and thus you need to factor that into the reward you are demanding , for taking that risk , even Berkshire gets wrong-footed from time to time

now one way to reduce delisting risks is to select a share ( or a distinct basket of shares , NOT an index )@divs4ever, for the next week, I’ll be sharing a “Quote of the Day” that ties into and enriches our ongoing discussion about backtesting and the associated risks in trading.

Skate.

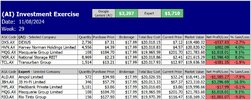

One of my AI picks is still holding up well, got to be a lucky pick but holding up with the latestest turmoil at 14% gains.

View attachment 182378

It's in the US exchange, I couldn't get it up on the Yhaoo platform at the time and just left there from day one.Quick Question

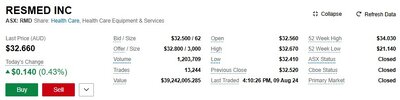

@TimeISmoney why is RMD not followed as an Australian security?

View attachment 182379

Skate.

I quite enjoy reading academic papers related to predictions on index movements, cross-sectionals, biases, pre/post events, etc. and seeing if there's anything I can statistically correlate to current markets.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.