- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

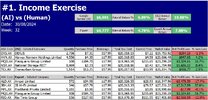

The article by Chris Conway of Livewire Markets, which inspired this exercise, highlights the evolving capabilities of (AI) in stock picking. As (AI) technology continues to improve, it will be interesting to see how it compares to humans in the field of finance.

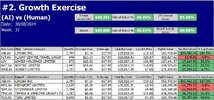

Explanation - Fundie vs AI: The best ASX "Income" stocks for the next 12 months

This is a theoretical investment exercise pitting Google's (AI) Gemini against Dr Don Hamson from Plato Investment Management in selecting five "Income" stocks for the next 12 months.

Fundie vs AI: Who is the better stock picker? (and 10 ASX stock ideas for your trouble)

AI is getting better, faster, & stronger. Will it ever be able to pick stocks like a human? We take a step towards answering that question.

Results after 32 weeks

We recognise that this is nothing more than a fun, but nonetheless important, thought experiment. Ultimately, (AI) will likely become a tool that all use to make more informed decisions, across a broad range of topics.

Skate.