- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

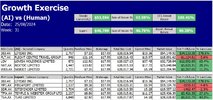

Surely the whole point of a technical approach is exactly that: 'timing'.

Market Timing

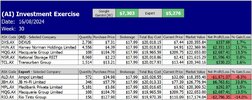

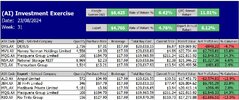

This signal aspect, “market timing,” is one of the elements that affect profitability, which can be improved by including the “PercentageUp Buy Filter” as an indicator of a buy condition. As the “PercentageUp Buy Filter” represents the percentage increase in the market, this indicator essentially identifies whether the market is bullish or bearish.

The “PercentageUp Buy Filter”

This filter allows buy signals to be generated when the advancing constituents of the XAO index are above 56%, which denotes a bullish market. Conversely, the method will time the exits of existing positions when the filter falls below 25%, indicating a bearish market. The “PercentageUp Filter” is a useful tool that enables the strategy to adapt to shifting market conditions.

@ducati916 quote nails it. With trading, it’s all about timing, and this is where a “buy timing filter” is one such method that indicates the optimal time when signals can be produced.

Skate.