- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

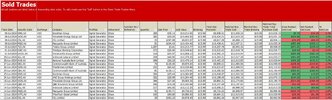

All I am Questioning is the Validity of the Smoke and Mirror Excel Values

@Captain_Chaza, It sounds like you’re questioning the accuracy or reliability of certain values. The term “Smoke and Mirror” suggests that you might think these values are misleading or deceptive.

Could you provide more details about the specific issue you’re facing with the Excel values? - For example, are you seeing unexpected results, or do you suspect that the data has been manipulated? This will help me understand your concern better and provide a more targeted response.

Skate.