- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Hi Skate

If I can ask - when you mentioned passed over because in shopping wallet money was not there and there was no opportunity to sell some from your current kitty and replace them with purchase of any one or two of the three buys ?

Regards

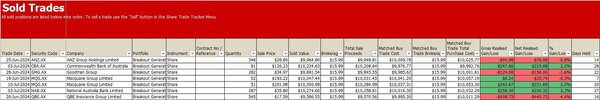

@Miner, the "Signal Generator" is a theoretical 10-position, $100,000 trading strategy that buys the 10 lowest-priced companies from a watchlist of the 20 largest ASX-listed firms, with no further positions added (passed over) until an existing holding is sold.

Once the strategy is fully allocated across the 10 initial positions, there is no further capacity to add new companies to the portfolio until an existing holding is sold, at which point any subsequently generated buy signals are passed over and not executed. This creates a static, fixed-size portfolio that can only be adjusted by closing out one position to open a new one.

By restricting the strategy to the 10 lowest-priced companies from the 20-stock watchlist, it aims to capture potential upside from a maximum of 10 companies. The strict 10-position limit and inability to add new holdings while fully invested are designed to impose investment discipline and prevent over-diversification.

Skate.

Last edited: