- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

no thank you

am nicely up on WES ( nearly $30 a share ) so will probably resist selling/reducing as well

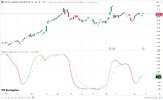

@divs4ever, everyone is driven by their own perceptions and personal biases, and we all strive to act in what we believe to be our best interests. However, the primary focus in trading should be on cultivating the discipline to follow a systematic approach without hesitation, regardless of the particular indicators or signals used.

Developing the ability to trade with a detached, unemotional mindset, where money flows freely in and out of positions, is the key to long-term success in this endeavour. With trend-following strategies, for example, it's common for half or more of the positions taken to result in losses. Knowing and accepting this probabilistic reality can actually make it easier to take the signals as they arise.

Ultimately, successful trading is a game of probabilities, not certainties. The trader who can condition themselves to execute their strategy consistently, without becoming overly attached to individual outcomes, are more likely to achieve sustainable profitability over time.

With trading, perception is everything

How we interpret and make sense of the market is what truly matters. The same data can be perceived in vastly different ways - a glass may be seen as half empty or half full, and both perspectives have validity.

Skate.