- Joined

- 25 July 2016

- Posts

- 336

- Reactions

- 680

Any clarity on how , why and when you add to QYLG?So is this 'strategy' ending on 30 June 2024?

Obviously the answer is yes.

So fairly pointless for me to continue the EWA strategy.

Rather, what I will do is demonstrate a strategy in the US that could be replicated (possibly) in Aus.

This is the same strategy that I would have implemented with EWA, but in the US it just provides so many more possibilities to structure the trade.

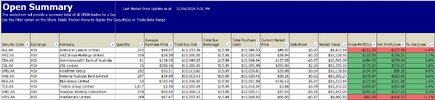

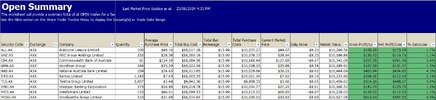

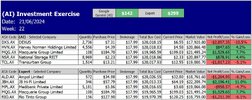

View attachment 178787

View attachment 178786

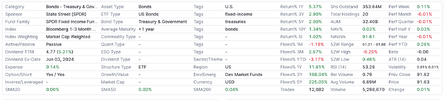

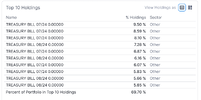

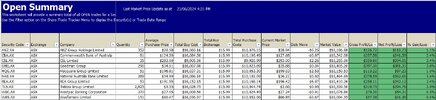

So you allocate a % of your $100K to stock, in this case QYLG which 50% hedges its position by selling covered Calls and BIL which is a short term Treasury paper.

Both provide a yield.

So in this instance I will go 20% QYLG and 80% BIL.

As I add to the QYLG position, I sell BIL to obtain the cash with which to fund that purchase. This way (obviously) you obtain a far better overall return.

I'll use Monday's closing prices as my start point.

jog on

duc