- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Objective

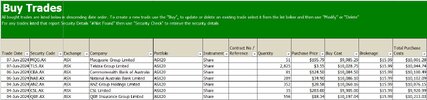

This hypothetical investment exercise measures the performance of Australia's top 20 listed companies as of the 1st of May 2024. The aim is to explore the year-to-date returns of investing $100,000 ($5,000 in each of the 20 companies) from the 1st of July 2023, considering capital gains and dividends. The ASX20 investment strategy is rebalanced annually to simplify the process. It's important to note that survivorship bias was introduced in the initial analysis. The primary goal of this exercise is to demonstrate a streamlined approach for newcomers to participate in the markets easily.

Exercise end date

The final post for this exercise will be presented on Sunday the 30th of June 2024.

Skate.