- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

The (3. SMACD-Coloured Strategy) is adapted from a Smoothed MACD indicator

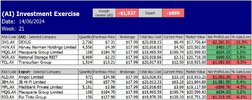

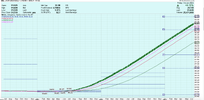

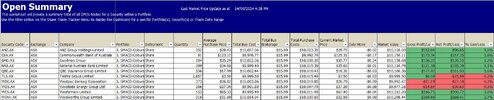

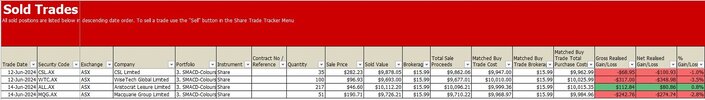

This hypothetical trading exercise is the third of three MACD trading strategies under review. This strategy is designed to trade 20 large ASX companies as of the 1st of June 2024.

The (SMACD-Coloured Portfolio) is diversified across 10 holdings, each allocated $10,000, capping the total of each strategy at $100,000. This ongoing exercise will provide a clear assessment of the relative merits of this trading strategy.

Skate.